Eagle Business Credit was founded to provide growth solutions through invoice factoring for small and medium sized American businesses.

Our management team has over 100 years’ experience in managing and financing receivables. Our dedicated team is employed to understand our clients’ and prospective clients’ specific funding requirements in order to provide them with the right factoring service. If our factoring services do not provide a fit for a prospective client we will work hard to put them in touch with someone we know and trust who can help. Our goal is always to find a solution to our clients’ specific working capital funding needs.

FAST. FLEXIBLE. FUNDING

Accounts receivable financing, also known as factoring or discount factoring, improves your cashflow by turning your outstanding invoices into cash. Working capital loans for small business are difficult and expensive to obtain from traditional lenders, but getting working capital from factoring is fast and simple and applying is free!

WHAT IS FACTORING?

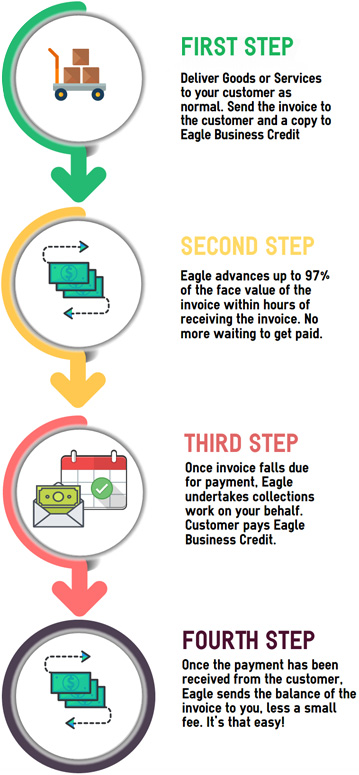

Factoring, or financing receivables, is done when a business sells its open invoices to a factoring company at face value less a discount fee. When you factor, you can get the cash you have earned today rather than waiting 30, 60, or 90 days to collect from your customers. Invoice factoring companies give you cash for a percentage of the invoice value up front, and then collect the invoice from your customers, paying you the unadvanced portion, less a small fee. It sounds simple because it is simple. Your time in business or personal credit won’t stop your ability to qualify and factoring has no impact on your balance sheet as it is not considered a loan.

Factoring can be used in a variety of ways, depending upon your business. Staffing factoring is an essential tool for this industry since there is a weekly payroll need and you might not get paid for 60 days. Export financing is another type of factoring. If you trade with overseas customers, you know that collecting from foreign businesses can be a complicated and drawn-out process, but when you factor those invoices, you get cash quickly and leave the collection work to the receivables servicing company. Trucking factoring companies and freight factoring companies give trucking loans based on the same principles: you get cash from the factor as soon as the delivery has been made and then the factor collects from the customer.

Eagle Business Credit is pleased to provide invoice factoring services to many businesses across GA including Woodstock, Marietta, Alpharetta, Atlanta, Roswell, Norcross, Cumming, Columbus, Macon, Savannah, and Dalton, as well as nationwide areas. Don’t let a lack of cash slow you down; call us today and you’ll be growing your business tomorrow!

READY TO GET CASH FOR YOUR BUSINESS NOW?

Call us today and find out how easy it is to turn your unpaid invoices into funds you can use to grow tomorrow.