Small Business Funding in Alabama

Eagle Business Credit offers invoice factoring solutions to businesses across Alabama, including Montgomery, Birmingham, and Huntsville. Factoring grows with your business and improves your cash flow. It is easy to qualify for factoring compared to a bank loan or line of credit. Sell your receivables to Eagle and get funded immediately.

“Thank you very much for helping us become the company we always wanted to be. Without your guys’ help–especially Angela, Michael, Dan, and Ian–I wouldn’t know where I’d be today.”

– Luis R, Alabama

Invoice Factoring Company in Alabama

Cash flow problems cause 82% of small business failures. This is a common obstacle to small business growth as well. Healthy cash flow through invoice factoring services is a debt-free business funding option for small business owners looking to grow. Eagle Business Credit is an invoice factoring company in Alabama that offers customizable funding solutions that enable small business growth. Working capital funding through invoice factoring is not reliant on a business or personal credit score. Instead, you perform the work and sell your receivables to a factoring company like Eagle for immediate payment on your open invoices.

FUNDING LINES

1,000 TO

5 MILLION

RATES AS LOW AS

1%

GET MONEY IN

24

HOURS!

The Heart of Dixie

Alabama, the 22nd state to join the United States, has a growing economy across diverse sectors. Historically engaged with agriculture, railway transportation, coal and steel, the Heart of Dixie’s economy has shifted to rely on manufacturing and technology. Producing one quarter of all passenger vehicles in the South, Alabama is home to crucial Mercedes, Honda, and Hyundai plants. With the building of the Saturn V in the peak of the Space Race, Alabama’s aerospace facilities were instrumental in getting man on the Moon. The downtown area of Birmingham has seen a 40% residential growth, restoration of historic buildings, and entrepreneurship exploding in the service and information sectors. Still, its rich black soil and established transportation infrastructure leads Alabama to be an important player in agricultural processing and shipping.

Core Industries:

- Automotive

- Chemicals

- Technology

- Forestry

- Aeronautics

Invoice Factoring Company in Alabama

Eagle Business Credit serves businesses across Alabama, including those in Birmingham, Huntsville, and Montgomery. Alabama boasts a booming aerospace hub in Huntsville, a decades-long revival in Birmingham increasing business tax revenue by more than $16 million, and Hyundai’s first North American manufacturing plant located in Montgomery.

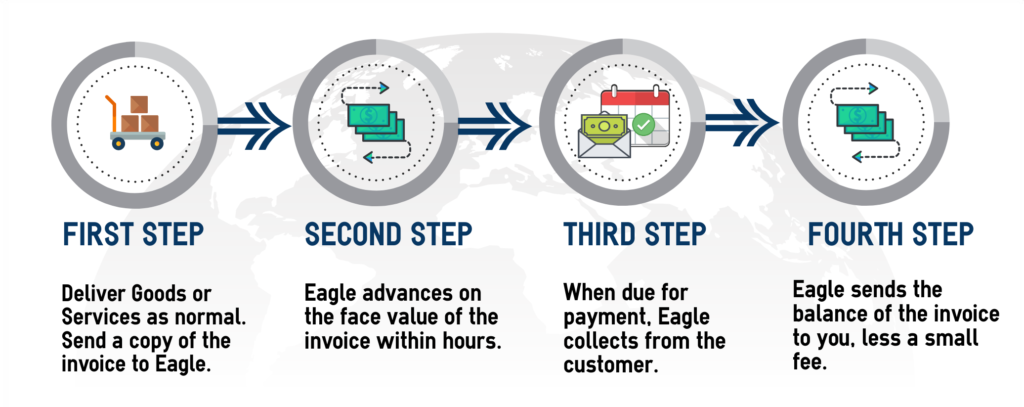

How Factoring Works

A State to Start Your Business

Huntsville, home of the U.S. Space and Rocket Center, is aptly recognized as the nation’s top metropolitan area in aerospace and defense with Boeing Co. bringing $2.3 billion annually to the Alabama economy and Marshall Space Flight Center serving as the third largest employer in the state.

Montgomery, the capital of the state, is home to Hyundai’s first North American manufacturing plant, employing more than 3,000 Alabamans.

The Honda manufacturing plant in Lincoln, Alabama employs more than 4,000 people and recently expanded its 4.2 million square foot facility by 400,000 square feet.

How can business invoice factoring help your Alabama business?

Here’s how it works. Your company sells your accounts receivable to Eagle Business Credit. We pay you up to 90% of the invoice value. You’re now free to sell without cash flow constraint or waiting to be paid by your customer. Accounts receivable funding takes the stress out of doing business. Cover your business expenses and quit waiting to get paid.

BUSINESS

FUNDING

AS EASY AS

READY TO GET CASH FOR YOUR BUSINESS NOW?

Call us today and find out how easy it is to turn your unpaid invoices into funds you can use to grow tomorrow.