Companies are announcing layoffs, with the second largest ocean carrier in the world downsizing their headcount by 9% within the next year. Banks are also tightening their lending criteria as expected during times of economic uncertainty. When the economy takes a downturn possibly to recession, there is a strong working capital solution for small businesses available: Invoice Factoring.

Invoice factoring is a solid working capital solution during an economic downturn. Here are the facts:

- Access to immediate cash flow

- Our same-day funding allows for fast financing and quick pivots in business operations.

- Instant cash release from capital tied up in your receivables can make the world of difference when you need to make game changing decisions to stay strong during recession.

- Debt-free

- Recession is a horrible time to fall prey to a debt spiral from high monthly repayments in the event your revenue takes a hit.

- Eagle’s debt-free funding gives your business strong cash flow without draining your cash reserves.

- Creditworthiness not required

- We don’t scrutinize your business or personal credit. We care about your customers’ credit—offering great financing to new or growing businesses that might not have perfect credit history.

- Quick approval & funding

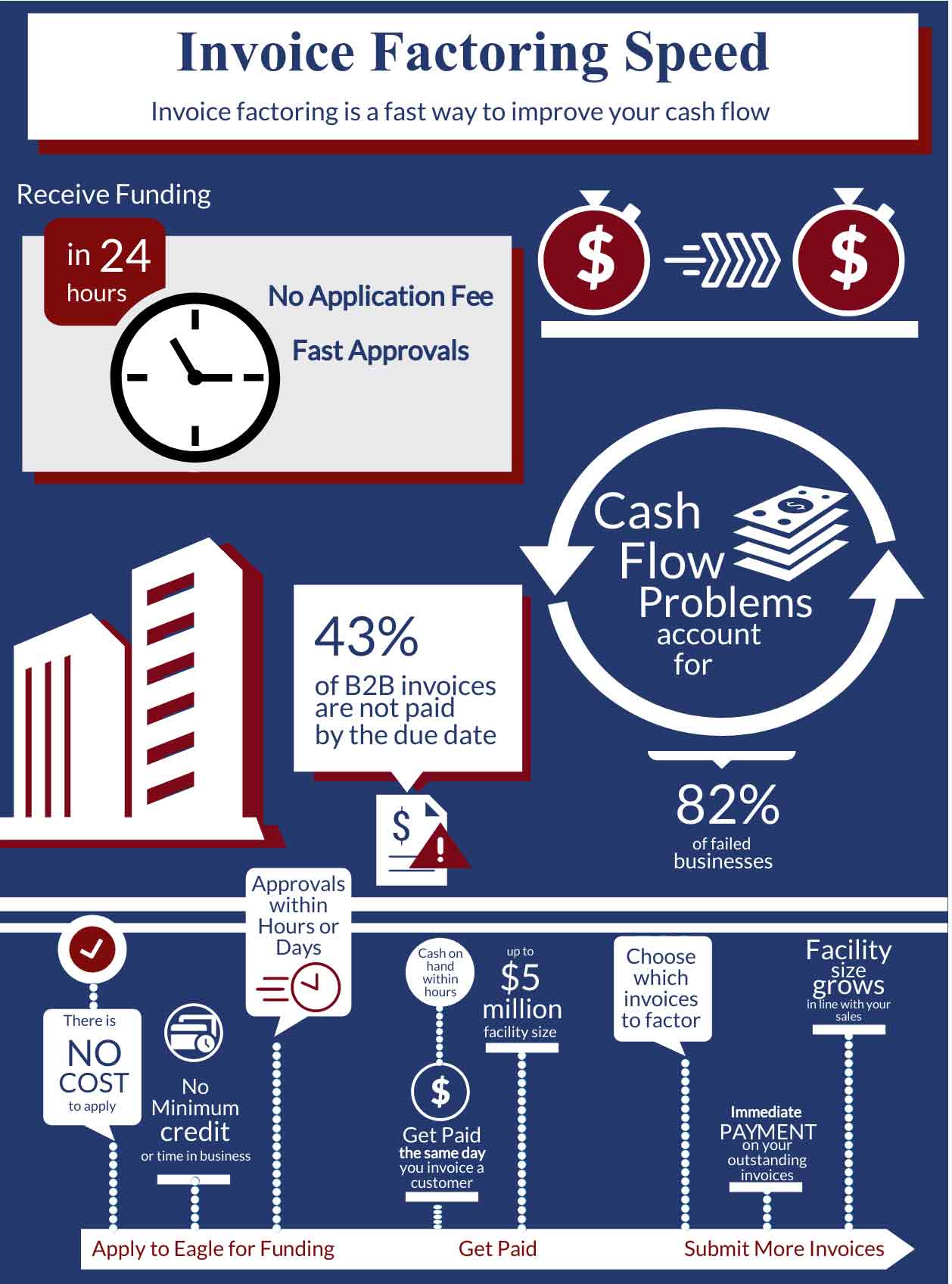

- Eagle can provide approval within 24 hours and funding within the same week.

- One you sign your docs, we can get you set up and on the road to strong cash flow.

- Flexible

- Factoring is tailored to your business’s specific needs, providing one-of-a-kind financing solutions to one-of-a-kind businesses.

- Choose which invoices to factor, maximizing your cash flow during unstable cash flow periods.

- Focus-inducing

- Outsourcing your receivables management gives you the time and focus to hone in on your core operations and make the adjustments necessary to not only survive but thrive even during economic downturns.

In times of economic uncertainty, small businesses often find themselves facing the challenging task of maintaining stable cash flow. During recessions, banks tend to tighten their lending criteria, making it more difficult for small business owners to secure traditional loans. However, there’s a financial lifeline that can help businesses weather the storm and keep their operations running smoothly.

What is Invoice Factoring?

Invoice factoring, also known as accounts receivable factoring, is a financing solution that allows businesses to convert their outstanding invoices into immediate cash. It’s an alternative to traditional loans, offering a dependable source of working capital during tough economic times. Small business owners can sell their outstanding invoices to a third-party financial institution, known as a factor, at a discounted rate. In return, the factor advances a significant portion of the invoice value to the business, typically around 80-95%, within a short timeframe, often just a few days. Once the customers pay the invoices, the factor releases the remaining amount, minus a fee.

Advantages of Invoice Factoring in a Recession

Access to Immediate Cash Flow

In times of economic downturn, maintaining cash flow is essential for business survival. Invoice factoring provides immediate access to cash, ensuring that businesses have the necessary funds to cover operational expenses, pay suppliers, and seize growth opportunities. Eagle offers same-day funding when a business submits an open invoice, eliminating the need for waiting 30 or 60 days on credit terms.

Debt-Free

Unlike traditional loans, invoice factoring does not create debt on your balance sheet. This means you won’t have to worry about monthly loan repayments, interest rates, or the risk of falling into a debt spiral. Your business can stay financially agile while still accessing the capital it needs.

Creditworthiness Not Required

Small businesses with limited credit history or poor credit scores often struggle to secure loans from traditional lenders during a recession. Invoice factoring focuses on the creditworthiness of your clients rather than your business, making it a viable option for those who might not qualify for a bank loan.

Quick Approval and Funding

Traditional bank loans can involve lengthy application processes and approval timelines. In contrast, invoice factoring is a swift solution. Small businesses can get approved and funded in a matter of days, ensuring they can respond quickly to changing market conditions.

Flexible Financing

Invoice factoring is scalable and can be tailored to your business’s specific needs. You can factor as many or as few invoices as you want, allowing you to manage your cash flow efficiently. This flexibility is crucial during periods of economic instability.

Focus on Core Operations

By outsourcing the management of accounts receivable to the factoring company, small business owners can dedicate more time and resources to running their businesses. This streamlined approach can be a game-changer during a recession when operational efficiency is key to survival.

Resilient Business Funding During Recession

In the face of an economic recession, small business owners need reliable and stable cash flow more than ever. Invoice factoring offers a lifeline by providing immediate access to working capital without the burden of debt. It’s a flexible and quick solution that doesn’t rely heavily on your business’s creditworthiness, making it an attractive option during times when banks are risk-averse to lending.

As you navigate the challenging economic landscape, consider incorporating invoice factoring into your financial strategy. By unlocking the value of your accounts receivable, you can ensure your small business stays resilient and financially sound during turbulent times, ultimately emerging stronger on the other side of the recession.