Obtaining a working capital line of credit should be an essential step for small businesses seeking a steady, predicable flow of funds. As a functioning business ourselves, Eagle Business Credit totally understands the importance of access to funding to cover day-to-day operating expenses such as payroll, rent, and other overheads. A working capital line of credit serves as a flexible financing tool, allowing businesses to draw funds on a revolving basis up to a predetermined limit, which aligns perfectly with the ebb and flow of business cycles.

The application process for this form of financing can sometimes be difficult and take several months but Eagle Business Credit is dedicated to making this process as seamless as possible, providing support and guidance to our clients. The key to a successful application with us is having open receivables for sales completed to other businesses rather than the traditional approval process undertaken by banks where you need to demonstrate a proven financial performance track record, a satisfactory credit score and tangible collateral to support.

We position ourselves as partners in your business’s growth, offering tailored financing solutions including working capital lines of credit. Our team specializes in understanding the unique challenges small businesses face and can offer insights on how to navigate the application process effectively. This ensures that when you’re ready to apply,the process will be quick, simple and easy.

Understanding Working Capital Needs

Before applying for a working capital line of credit, it’s crucial for a business to recognize the significance of managing their company’s day-to-day financial health and the need to ensure there is sufficient working capital to cover the immediate operational expenditures without disrupting cash flow.

Evaluating Cash Flow and Expenses

Cash Flow: To maintain a healthy business, cash inflow and outflow needs to be diligently monitored. It’s essential to track the liquidity of the assets needed to meet short-term obligations. Regularly assess the money coming in from accounts receivable versus the money going out for expenses like payroll, rent, utilities, and inventory purchases.

- Inflow Sources: Primarily from sales; other sources could be investment income or asset liquidation.

- Outflow Channels: Regular operating expenses, spontaneous cash flow gaps that may arise, and inventory replenishment.

Expenses: Meticulously list and analyze all day-to-day expenses. This attention to detail helps to pinpoint areas where costs could potentially be reduced or payments managed more effectively.

A detailed expense tracking includes:

- Fixed Expenses: Rent, software subscriptions

- Variable Expenses: Utilities, inventory purchases, payroll

- Periodic Expenses: Tax payments, equipment maintenance

The Role of Working Capital

Working capital is the lifeline of a daily business operation. It is the difference between current assets and current liabilities. Effectively managing working capital is imperative for all businesses, including cash flow experts like us at Eagle Business Credit, as it reassures us that we have the flexibility to address any short-term financial commitments as well as invest in our business growth when opportunities arise.

Key Components:

- Assets: Primarily cash, inventory, and accounts receivable.

- Liabilities: Loans, accounts payable.

Our aim is to maintain a positive working capital balance, ensuring that we can comfortably cover our short-term liabilities. We also proactively work on strategies to shorten the cash conversion cycle, speeding up the process of turning inventory and receivables into liquid cash, thereby bolstering our cash flow and working capital adequacy.

Eligibility and Requirements for Application

Before applying for a working capital line of credit with us at Eagle Business Credit, it’s crucial to understand the specific eligibility criteria that other financial institutions like banks may require and the necessary documentation to ensure a smooth application process. These are as follows:

Credit Assessment and Score Relevance

Most other financial institutions, including online lenders, place significant emphasis on your personal credit score as it’s a pivotal component of their eligibility criteria. Credit scores provide them with an insight into your past financial responsibility and creditworthiness. Typically, a good credit score increases your chances of approval for a working capital line of credit and a the higher the score, the lower the interest rate. At the time of writing, Amex Business Line of Credit requires a FICO score of at least 660 for their business line of credit, but this may need to be in the 700’s for other banks, with scores in excess of 720 to qualify for the best interest rates and terms.

Importance of Financial Statements

Their assessment of your financial statements is integral to their application process. These documents give them a comprehensive look at the financial stability and health of your business. Key documents include your balance sheet, income statement, and cash flow statements, which show them your business’s supposed capability to manage new debt effectively.

Business History and Revenue Criteria

For eligibility, banks require a solid business history and consistent annual revenue. These factors demonstrate a track record of profitability and sustainable operation which are crucial for them to gauge future performance. They generally look for businesses that have operated for a specified minimum number of years and meet a set criteria in annual revenues, indicating their capacity to repay the credit line.

Eagle Business Credit takes a very different approach to the approval process. As we use your open accounts receivable as the basis of determining the line of credit, we primarily focus on what you do and who you do business with rather than the length of time you have been in business as they will be the ones that pay down your line of credit when the invoices fall due for payment rather than you making loan repayments. Do you have good customers? Do they have an established and reliable payment track record?

Applying for a Working Capital Line of Credit

When considering a working capital line of credit, it is crucial to understand the application steps, what documentation you’ll need, and how to choose the right lender for your unique business needs.

Detailed Application Process

The application process for a working capital line of credit with Eagle Business Credit involves several stages. Initially, you need to determine the amount of credit your business requires to support ongoing operations. Past this initial determination, the steps typically involve:

- Complete a short, one page application form. You can do this here.

- Eagle Business Credit will discuss your needs with you and determine the right facility for your business.

- A proposal of terms will be issued for your approval.

- You will be asked to provide a short list of information, such as an accounts receivable listing, sample invoices with supporting documentation and a copy of your ID.

- Your file will be passed to underwriting for their review. This should only take a few days at most. If you have other lenders who have filed a security interest against your Accounts Receivable, it may take some additional time to sort.

- Approval issued and your account set up ready for funding.

It is important to engage with lenders that explain each step clearly, like Eagle Business Credit, to ensure a smooth process and understand how long it might take.

Documentation and Information Needed

To successfully apply for a business line of credit, you must prepare and submit various documents that demonstrate both your personal and business financial status. Crucial documentation asked for by traditional lenders usually includes:

- Personal Information: For identity verification and credit evaluation.

- Business Tax Returns and Financial Statements: To show historical profitability and tax compliance.

- Business Plan: Laying out strategic financial forecasts and operational goals.

- Bank Statements: Displaying cash flow patterns and financial health.

Eagle Business Credit is different. Unless you are looking for a line of credit of over $500,000, you are likely only to be asked for documentation relating to your Accounts Receivable and some basic company formation documents such as a copy of your articles of incorporation and any operating agreement and your ID to help prevent identity theft. For larger facilities, you may also be asked for some information on your Accounts Payable and past financial performance if you have financial statements available.

Selecting the Right Lender for Your Business

Choosing the right lender for your business involves careful comparison and consideration of several factors:

- Reputation and Reliability: Seek lenders with positive reviews and a track record of supporting businesses, like Eagle Business Credit.

- Terms Offered: Evaluate interest rates, fees, and flexibility to find the most beneficial agreement for you.Will you be tied into a lengthy contract? Will there be a cost to leave?

- Specialization: Some lenders specialize in certain industries or types of business financing. Will your choice understand what you do?

- Accessibility: Consider the ease of communication and support, especially if you prefer a more personalized approach like the one taken by Eagle Business Credit over large, impersonal institutions.How easy is it to speak to a decision maker if you have a question? Can you actually speak to anyone or will you be sent to voicemail and never called back?

We encourage you to consider your unique situation and choose a lender aligned with your business objectives and financial needs.

Terms, Costs, and Management of Credit Lines

When considering a working capital line of credit, it is crucial to understand the intricacies of interest rates, fees, and repayment terms. You need to ensure that you manage your funding lines effectively to sustain financial health and growth.

Interest Rates and Fees Explained

Interest Rates: The cost of borrowing funds through a standard line of credit is primarily influenced by an interest rate. Interest rates are generally variable, which means they can fluctuate based on market conditions and have increased significantly over the last couple of yearsAdditionally, lenders may charge draw fees, which are fees for accessing available funds, and may include other fees such as annual renewal or monthly maintenance fees.

Fees:

- Set up/ Application Fees: A fee charged to initially apply for the

- Draw Fees: Cost per transaction when funds are withdrawn.

- Monthly Maintenance Fees: A monthly maintenance fee to administer the line on an ongoing basis

- Annual Fees: A yearly cost for renewing the credit line.

- Late Payment Fees: Penalties for overdue payments.

The Significance of Repayment Terms

Lines of Credit differ from Term Loans where a set amount is received and regular payments made over a defined period to repay the loan. The amount to be repaid on a term loan will include the fees and interest and may be on the following terms:

Repayment Options:

- Interest-Only Payments: Pay interest initially, principal later.

- Amortized Payments: Combined principal and interest over time.

A line of credit generally operates on a revolving basis. A business using a line of credit can draw up to a specified amount over a given period. It pays interest and fees on the balance drawn, which is paid down by funds received into the account.

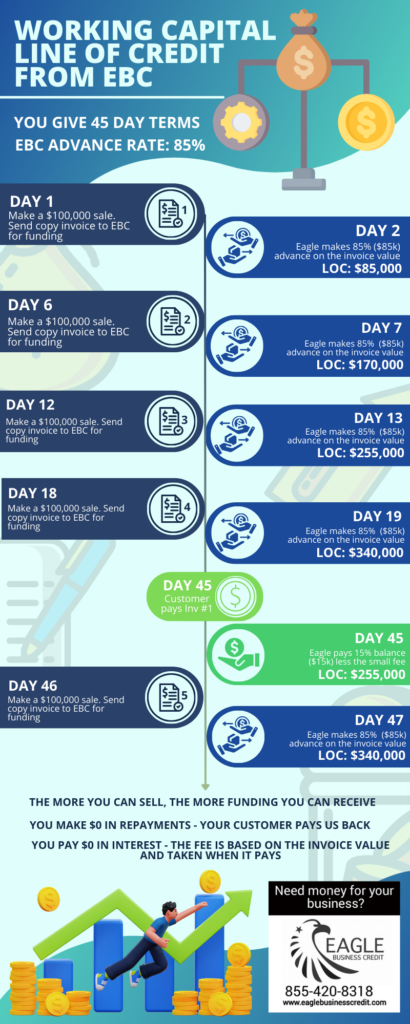

A working capital line of credit from Eagle Business Credit works in a similar way but uses the invoice values as the basis for the amount that can be drawn down. Fees are generally charged based on the invoice value rather than an interest cost.

Frequently Asked Questions

In this section, we address common queries you may have as you prepare to apply for a working capital line of credit

My business has grown rapidly over the last year, but I don’t have financial statements that show this. Can I be approved for a funding line with you?

Rapid growth is a great problem to have and shouldn’t hold you back from obtaining larger funding lines. We will review your accounts receivable and approve you based on that, rather than financial statements, even if you have some for us to review.

I’ve only been in business a few months. Can I be approved for a working capital line of credit?

As Eagle Business Credit focuses on who you do business with and not you or your business you will be approved as long as you are selling to creditworthy customers.

How do I know my customers are creditworthy?

Eagle Business Creditare experts in credit management and have access to payment information for thousands of businesses across the world. As a client, you also have access to this information, totally free of charge and should check out any potential new customers before you supply them to help potentially avoid a no-payment problem in the future.

What are the typical requirements and steps involved in securing a working capital line of credit?

Typically, lenders require detailed financial records, credit scores, business plans, and possibly additional collateral. Start by submitting a free, no obligation application to a lender like Eagle Business Credit who doesn’t need this information to make an approval and will be able to let you know quickly whether you might be a good fit for them.Once terms are agreed, you will need to provide a small amount of additional information they require during the short underwriting process.

What are the common challenges in securing a working capital line of credit and how can I overcome them?

Poor debtor credit is one issue you may have to overcome. Another roadblock that might stand in the way is a prior security filing from another lender you may have worked with in the past. Wherever possible, we will work with that lender to have them either release that filing or subordinate the accounts receivable in our favor. We do this all the time so the process is normally fairly straightforward.