On this episode of Eagle Eye, CEO Ian Varley dives into the approval criteria for invoice financing facilities. Many business owners think that flexible, growth-enabling funding is out of reach due to a myriad of reasons. Invoice financing is reliable and can help your business grow. There are not unrealistic expectations for applicants. Below are the main areas that an invoice financing company will evaluate to determine whether you can you qualify for invoice financing.

1. Do you sell to commercial customers or have government contracts?

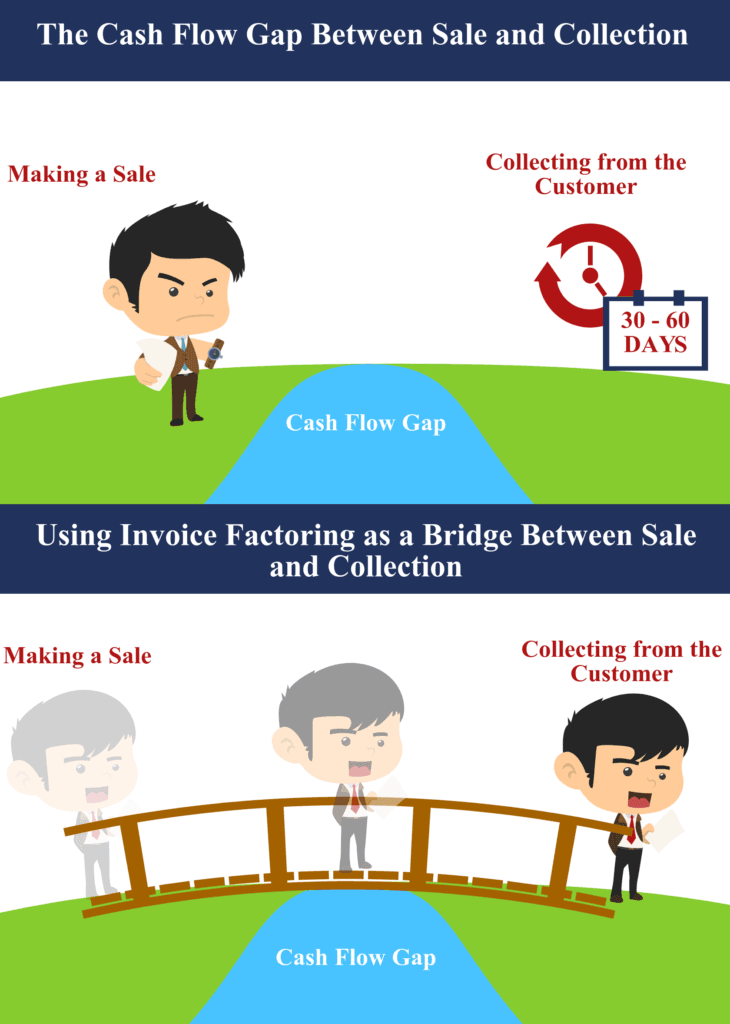

First of all, do you sell to individuals? Or do you sell to commercial customers? If you sell to commercial customers and give them 30 or 60 days credit, the answer is yes. You can qualify for invoice financing. We help all sorts of companies who sell B2B and not sell to individuals with their receivables financing needs. We bridge that gap between when the sale is completed, or the goods are delivered and when the customer pays. So, the credit that you’re being asked to give to that customer is the bridge in terms of financing that we will provide you.

2. Does your credit score matter?

Another question is: What about my personal credit? I have had some challenges. Can I still qualify? The answer is yes. It is not about your personal credit as the business owner. It’s about the customers that you sell to. Those are the people that we are going to look at in terms of credit worthiness to recruit your facility and not you and your personal credit. It’s not important to us so much as your customer’s credit.

3. Does your time in business matter to qualify?

How long have I been in business? I just started up. Does that mean that I can’t apply? No. You can apply. As long as you are in business and you have sales and you have receivables, we can fund you. We have a product called express funding that is specifically for new start companies that will take you all the way from the starting point through to a 50,000 dollar facility. And it’s very quick and easy to apply for. There is no minimum volume. And it’s a month-to-month contract. So very flexible, very easy.

4. Do you need high revenue to qualify?

No. You can graduate into a larger facility as your business grows. So, your revenue is not so much of a concern in terms of the volume that you have. We can help you from start up all the way through to 5 million in facility size. We cover a large range and variety of business and sizes.

Should you apply for invoice financing?

If you sell to other businesses on credit terms and have a need for better cash flow, consider invoice financing. It is very flexible to apply for invoice financing, and most businesses will qualify provided you have commercial receivables and you have those sales going through right now. Time in business and credit score are not major concerns for us. We work with all sorts of businesses in all sorts of shape.

Will invoice financing be expensive?

Our approval criteria relies on the strength of your receivables, so even startups or business owners with past bankruptcies will qualify. Further, our invoice financing services will not cost you an arm and a leg. That is typically a huge fear for business owners that do not have a perfect track record. Our pricing makes sense, and a bankruptcy, tax lien, or low credit score will not raise the pricing through the roof.