Q: What is the importance of working capital?

A: Working capital is your company’s assets minus liabilities. This number is inflated compared to the available cash in your business due to the amount of money often tied up in accounts receivable. Working capital is the pulse of your small business, and many lenders evaluate your working capital when determining business funding potential.

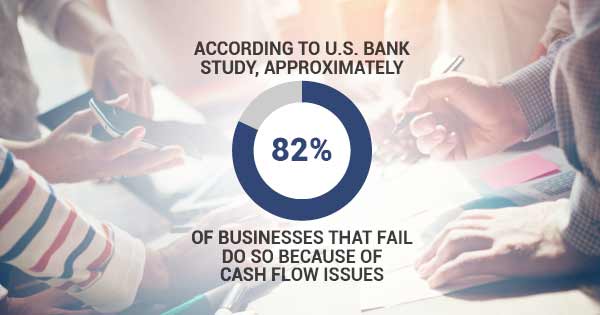

Q: Why is it important to manage working capital?

A: 82% of failed businesses cite cash flow as a cause. Although you may have more assets than liabilities, when these assets are not liquid, your business can struggle to cover overhead, payroll, and supply costs. Converting assets to available working capital is integral to working capital business with a growing business.

supply costs. Converting assets to available working capital is integral to working capital business with a growing business.

Q: Is invoice factoring worth it?

A: Ultimately accounts receivable funding can help businesses of all shapes and sizes. Working capital is necessary to scaling your business, and this is where invoice factoring services are perfectly positioned to benefit your growing business.

Q: Can invoice factoring startups help with cash flow?

A: Startup factoring means your startup business has a working capital funding strategy that grows with the business. Since funding potential for invoice factoring relies on your sales volume rather than your time in business, your growing startup has a source of working capital funding without the size limitations of bank loans or lines of credit.

Q: Can I use invoice factoring as a working capital financing strategy with bad credit?

A: Yes! Another use of invoice factoring services is for businesses with bad credit. Traditional lenders rely on business credit or an entrepreneur’s personal credit to determine funding decisions. Since there are no repayments involved with small business factoring, credit score is not a major factor in funding potential.