Fear – noun– an unpleasant emotion caused by the belief that someone or something is dangerous, likely to cause pain, or a threat.

I didn’t think I was scared of spiders until I came face to face with the largest spider I had ever seen before. I was in California talking to my wife on the phone. There I was, in mid-conversation, boasting about how nice the weather was–it was November and she was in a cold and wet England with two small children–when all of a sudden, I stopped talking. After what seemed like an eternity my wife said, “Are you still there? What’s the matter?”

All I could say was, “It’s-it’s a spider.”

I really did not appreciate her response of “Is that all? Pull yourself together.” It was the largest spider I had ever seen without a very thick piece of glass separating me from it at a zoo. Did these creatures really roam wild around somewhere I was about to move to? Did I need to reconsider my plans?

Wind the clock forward 17 years. I’m still in the USA, albeit on a different coast,. I’m still in the factoring industry, but now I run my own company. So, what do I fear? Spiders are still high on that list. However, I’m scared for the future of small businesses and their ability to find the money they need to survive.

Fear of Loan Rejection

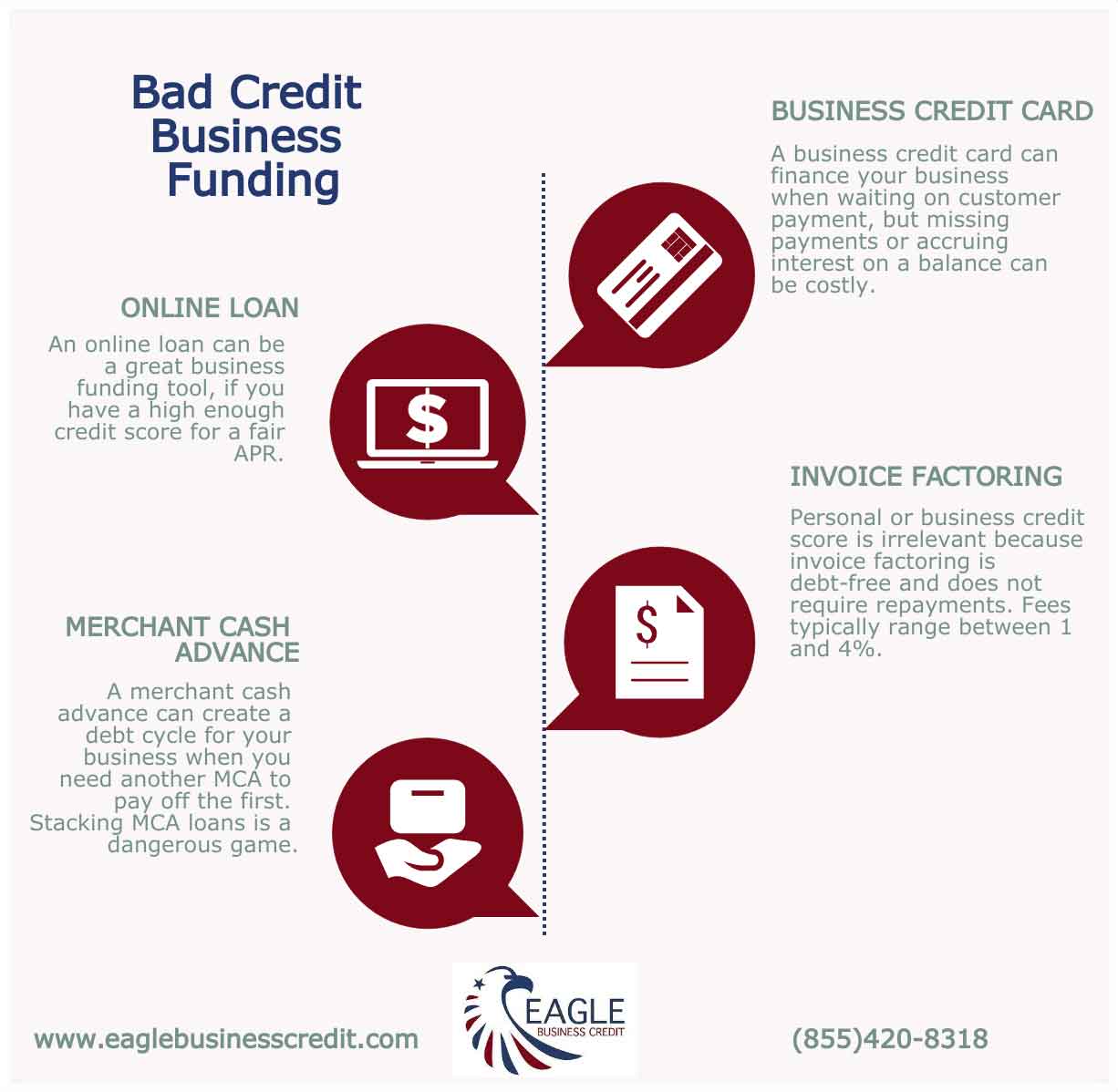

In much of the financial world, personal or business credit is huge. It can determine whether you are approved or denied, how much funding you are offered, and what interest rates you can receive. Invoice factoring companies, however, do not care about an applicant’s credit score. It simply is not crucial to the underwriting process. This means that many business owners with poor personal or business credit can access funding from factoring companies like Eagle Business Credit.

Are Factoring Companies Scared of an Applicant’s Credit Score?

Spiders are still very real and very scary. Aside from never leaving your house, you will have a few run-ins with spiders, but business credit does not have to be scary. Business or personal credit is an area where factors can be fearless. Factoring companies are not scared of accepting applicants with less than perfect business or personal credit scores. Business owners have access to an awesome cash flow solution, and inevitably, your business credit will improve while you factor invoices.

Small businesses employ almost 50% of the total workforce in the U.S so the impact on our economy if a large proportion of them should fail would be catastrophic. Economic stimulus payments will not last forever and banks are massively tightening their lending criteria, with approvals at the lowest rates in years. Even alternative lenders are pulling out of the market so viable funding options are getting even more limited.

Factoring Helps Businesses with Poor Credit

Cue, Factoring. Good old Factoring. Proven over and over again to work in downturns as well as boom times. I’ve been in this industry for at least 4 significant recessions and have helped hundreds of businesses continue trading during those times, so again, what do I fear? I fear business owners don’t know what funding options are still available to them and they run the risk of running out of available working capital when they didn’t need to. Our approval criteria and plans are the same as they were, pre-Covid-19.

Fearless Small Business Funding

There is so much to fear today, but business funding shouldn’t be one of those fears. We call ourselves fearless funders because we extend credit to businesses that otherwise have limited options. Factoring is not an expensive product to take advantage of a situation. It’s a product that works to stimulate business strength and growth without wasting time or creating massive repayments. If you sell to other businesses on credit terms, we can generally help you.