Right now many business owners are looking for extra money for their business. Whether it be long or short term, there are many financing options that provide different benefits depending on the size and nature of your operations. Here is how to finance your business during COVID-19 right now.

Paycheck Protection Program

An article on financing your business during COVID-19 wouldn’t be complete if the Paycheck Protection Program wasn’t at the top of the list. If you’re a business owner, you have definitely heard of or even applied for this funding option. Be aware that loan forgiveness must be applied to within 90 days of the loan term, and that you must have spent at least 75% of the loan amount on just payroll. This funding is a great and low cost option for business owners needing to meet payroll, but you may need additional funds to cover the other expenses to your business.

Bank Loan

Bank loans are going to be hard to come by during this time. The SBA has an Economic Injury Disaster Loan that is processed by SBA approved lenders then by the SBA itself. This funding will take a long time to reach your bank account, but the interest rates will be low as long as you are a qualified applicant. Banks may be otherwise wary to lend to small businesses as is historically the case in American recessions.

Online Loan

An online loan may be more likely to lend to a small business, but many online lenders are themselves going out of business. The issue with algorithms determining credit worthiness is that an otherwise strong business could be determined a credit risk because of an unprecedented event…like COVID-19. Another concern with online loans is that you will be paying more than a bank loan, but it is a faster option for the majority of small businesses that have 28 days or less of cash reserve.

Crowdfunding

You could always turn to peers, family, and strangers to raise money for your business. This will be your cheapest option since it is basically accepting donations to continue your operations. The issue is that the funding is in no way guaranteed to raise enough or any capital. There will be a lot of businesses using crowdfunding methods during COVID-19. This is not a reliable source of capital for your business.

Invoice Factoring

When banks and online lenders slow or stop lending to small businesses, invoice factoring still does. Factoring goes back to Roman times and even before because it’s a simple and straightforward solution to business financing. This option may be more expensive than a bank loan, but the funding is fast, grows with the volume of sales of the applicant, and does not demand a lengthy time in business or high credit score.

Merchant Cash Advance

An MCA loan is an expensive funding option. The funding is fast, and you do not have to be a strong applicant to qualify for the funding. This option is often a bandage to the problem rather than the solution. Your cash flow will hurt from making daily or weekly repayments, but it has its uses for specific industries. Be sure to read the terms and conditions of the funding, and as always, watch out for hidden fees.

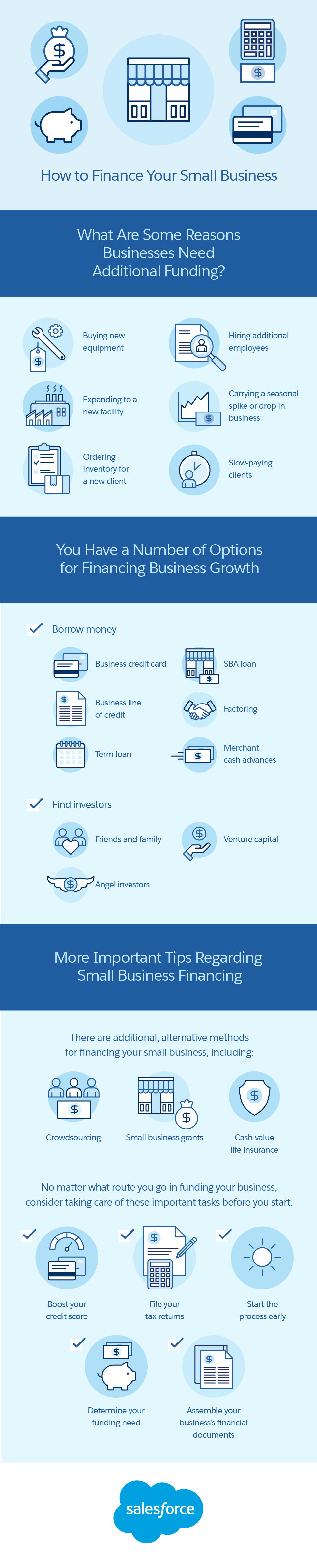

Click To Enlarge

Via Salesforce

How Does Invoice Factoring Work to Fund Businesses Long Term?

Rather than thinking short term, consider your longer term business financing options as well. Cash flow is important, so you want to improve your cash flow to be able to afford the recurring or new costs in your operations. Be sure to analyze your ability to repay the funding option you choose. Will your sales be strong enough to cover your operational costs in addition to the repayments you have to make? If not you could run into some bigger issues down the road.

You need a funding partner that is able to support your cash flow needs right now and in the future. Invoice factoring facilities that grow with your business are a smart choice for long term financing. There is no repayment to make, no debt, and no long term commitments necessary. At Eagle, we believe in retaining our clients through our unmatched service, not through contracts.

Financing Your Small Business During COVID-19

If you need money short term and long term, consider factoring services. The flexibility and improved cash flow from factoring will enable your business to grow, pivot, and function smarter even during “unprecedented times.”