Longer term pictures of cash flow can be important when wooing investors or bank underwriters, but the COVID-19 disruption in business can make this statement inaccurate when it comes to staying afloat short term. This is where a 90 day cash flow forecast can help you evaluate the financial shape of your business and whether you will be able to meet your obligations or even grow during or after this crisis.

Where to Start With a 90 Day Cash Flow Forecast?

The first step is to individually evaluate your customers. What are they paying and how long does it take to collect? Note how long it takes from making the sale to collecting the payment. Group similar-paying customers together, and pay attention to your larger customers. Even with the same terms (net 30 or net 60 for example) you may have varying payment histories from your customers. Don’t just rely on your invoicing to group your customers, do a dive into individual payment history to evaluate the sales cycle for each customer.

Cash Coming In

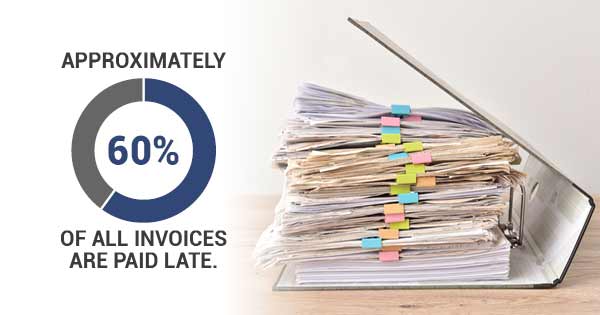

Accounts receivable will most likely be your largest pit of uncollected cash. Keep in mind that the payments of these open invoices may be questionable depending on the industry your customer is in. Hospitality, retail, and entertainment are all sectors that have been affected by the COVID-19 pandemic. As closely as you can, forecast the collections of these payments.

If you are applying to government funding programs like the PPP or the Economic Injury Disaster Loan program, factor these payments in. Do you have any excess inventory or equipment you can sell off? Is there an alternative lending partner that you’ve been eyeing for short or long term cash flow? Know the specifics of your options when evaluating you cash coming in.

Cash Going Out

First, look at areas that are not accounts payable. This means payroll, recurring weekly or monthly costs, and repayments to lenders or banks. Map these out for the next 90 days, then deep dive into your accounts payable. Take note of which suppliers are irreplaceable to your business and focus on meeting payment terms for these orders. If you find that you are unable to pay on time for all of your vendors, reach out to each vendor you foresee payment issues with and ask about payment plans. It’s never a good idea to pay late without speaking to your supplier about it. Many vendors are understanding about cash flow being tight during this crisis, so it’s worth a conversation about your options going forward and to preserve the business relationship. If you simply lose vendors from non-payment without having a conversation, your business will feel that pain when it comes to fulfilling customer orders.

Balance Sheets

After you’ve thoroughly reviewed your cash coming in and cash going out, you can create a weekly picture of balance sheet accounts for the next 90 days. Pay attention to accounts receivable, payable, and inventory. This process will show you whether your forecasts make sense for your business. You may find that they don’t make sense, and then you can identify the specific issues with your cash flow and overcome them.

Why Should You Create a 90 Day Cash Flow Forecast?

It’s crucial to dig into your sales cycle and cash flow forecasts in order to understand your specific strengths and shortfalls. It’s impossible to find a solution when you’re in the dark about the problem. It can be a scary process, but ultimately the benefit is to strengthen your business rather than stick your head in the sand and hope for the best.

What Can You Do With a Cash Flow Forecast?

Once you’ve identified the vulnerabilities and strengths of your business, you will know to some accuracy what cash your business needs to continue meeting costs and taking orders. Your 90 Day Cash Flow Forecast can be used in conversations with lenders. You have the most knowledge about how your business operates, so when you talk to lenders you can use this forecast to exemplify your needs and your ability to repay. Further, there are some lenders that focus on improving cash flow without requiring repayments. If your cash flow forecast simply shows a need for shortening the sales cycle in order to continue or even expand your production then it’s worth a look at these lenders.

How Does Invoice Factoring Affect Your Cash Flow Forecast?

Invoice factoring is one of the financing methods that improves cash flow without requiring repayment. It’s simply an advance on your receivables at a discount. Rather than waiting for customer payment, you get payment the same day the invoice is issued. The benefit to your business is having cash on hand immediately rather than waiting for credit terms to expire. The benefit to your customer is that they still pay when the net 30 or net 60 days are up. The factoring company is the business that waits for payments and they collect from your customer rather than your business waiting for collection.

How Does Factoring Affect Your Cash Flow?

Without having to stop and wait for customer payments, your business will have more available working capital to reinvest in your own growth or survival. Factoring is a fast form of business funding that typically can be established within a week for an applicant. Once you make a sale, you can move on to fulfilling the next sale without worrying about customer payment. You already have the money to take on new or larger orders. Below is an example of how factoring can grow your business.