Whether you have closed your business temporarily during the COVID-19 shutdown or whether you have still been operating at a reduced capacity, you have to plan to restart your business after COVID-19. Financing and managing your receivables will be key components of your plan to resume business. You also have to consider your employees, customers, and suppliers. Here are some tips to keep in mind when planning to restart your small business after COVID-19.

Contact Your Suppliers

COVID-19 has affected a lot of industries in different ways. Some companies have pivoted to produce items more in demand during this time, and some companies have just shut their doors for the time being. The first step you need to take concerning your suppliers is contacting them. Call them to see if they are operating and at what capacity. You don’t want to accept a purchase order only to find out you don’t have a viable supply chain. Have a conversation about the timeliness and costs of their services, and make sure your supplier is still the smart and reliable choice for your needs.

Staffing

If you haven’t already, you need to be in open communication with your team. You should lay out timelines, processes, and expectations for the whole team. When restarting your operations, safety and sanitation must be top of mind. Clearly explain the new safety processes, and if it is not safe to restart your business, don’t. Keeping your team should be a priority for you. It’s costly to have employee turnover, and if you take care of your team, they will put in their time and effort into their work. If you are looking to add to your team, a staffing agency is a smart choice due to the flexibility and limited financial burden it places on your longer term cash flow.

Customers

After contacting your suppliers, and having open and honest communication with your team, you should reach out to your customers. Touch base with your existing clients and discuss their needs. Understand that their needs and their means are probably different than before COVID-19. See what your company can do to fulfill their needs, and discuss payment options. Maybe they need your services or goods, but they won’t be able to pay within 10 or 20 days of invoicing. Consider renegotiating credit terms depending on the needs of both yourself and your client. Inquire about any outstanding invoices and the time expectation of payment.

Strategy

Your marketing, sales, financing, and operations strategies may all be different now than they were before COVID-19. In order to restart your business successfully, you have to manage your existing client base in the short term along with acquiring new customers or increasing sales volume in the long term. It can be expected that your business will take a hit from COVID-19 because many businesses will, including your customers. Having the honest communication between your company and those around you will help mitigate some potential credit risks or road blocks down the line. Consult with your business plan, and just see if it still makes sense. Meet with your different departments and ask your senior team members if they see any gaps or vulnerabilities in their departments.

![]()

Finances

All of these discussions with your suppliers, customers, and employees should be informed by your financial health. Do you have enough cash reserve to restart your operations? 75% of businesses only have 28 days or less of cash reserve. The shutdown might have completely depleted your funds, and restarting could look like a pipe dream. You may need a faster financing solution than a bank loan, and during recessions banks typically slow on their lending to small businesses. Possibly you’ve taken an SBA loan or the Paycheck Protection Program to help keep your business going during this shutdown. You may still be in a financial crunch once repayments are due and bills start piling.

In order to understand your financial health, you should create a cash flow forecast. This exercise will show you your needs and your pain points when it comes to financing your business. Once you know what you need to cover and how much cash you will have on hand at any point during your cash flow cycle, you can focus on running your business.

Will You Need Business Financing?

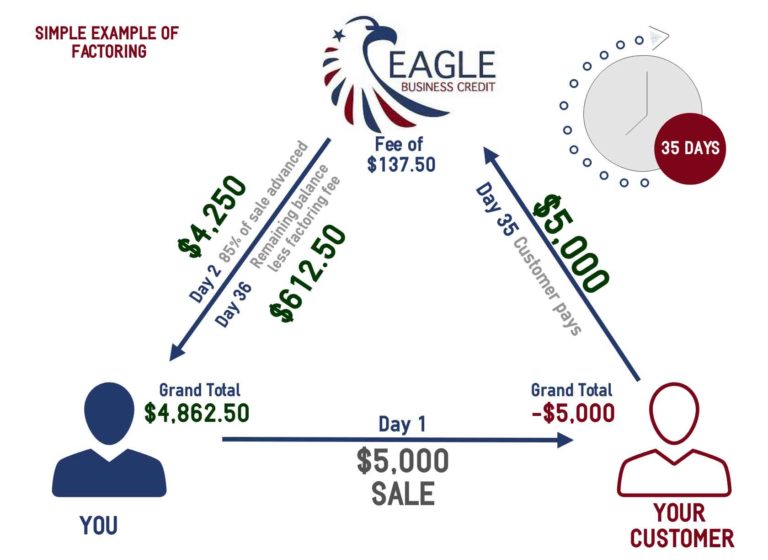

Even if you’ve taken an EIDL or PPP loan, you may need help with some outside financing. Some financing options, like accounts receivable funding, will improve your cash flow and enable your business to make loan repayments, cover supply costs, and cover the other expenses your business will face. The benefits of accounts receivable financing is that your business will have healthy cash flow and the monetary ability to function smoothly. You won’t miss payroll or make late payments to suppliers. Instead, you can afford to make more sales or larger sales.

The flexibility that comes with accounts receivable funding or factoring services enables your business to be creative. You can pivot if your current strategy isn’t working out. You can choose which customers’ invoices you want to factor. You are not obligated to factor customers that pay quickly. Invoice factoring is simply a faster way to finance your business without adding to your debts.

Consider your longer term financial needs. When you choose a financing partner, you will want one that knows the pain points of businesses in your industry and will work to support your growth, not just your survival. Invoice factoring is a financing option that grows along with the needs of your business. The more sales you make, the more funding you have. During recessions, factoring companies tend to pick up the slack of other lending institutions. This is because there is lower risk and less credit or time in business requirements for approval. Don’t settle for an expensive financing option or insufficient funding. Find a lender that will finance your business during rough patches and green pastures.