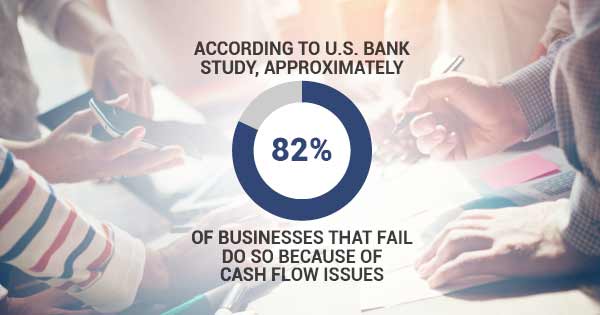

Cash flow is the number one cause of small business failure. Cash flow has been hurting across the board, and small business owners are feeling the pain. Most small businesses are reopen again in some capacity, but most businesses are also preparing for another shutdown due to a second wave of COVID-19. Even with Paycheck Protection Program loans, small business owners are concerned about cash flow. Here is how to avoid small business failure.

Small Business Cash Flow and PPP Forgiveness

The Paycheck Protection Program was intended to keep employees on payroll during the shutdowns caused by COVID-19. A major appeal of the PPP was the possibility of loan forgiveness. Unfortunately, the criteria to meet loan forgiveness required spending a majority of the loan amount on payroll over an 8 week period. Many small business owners found this challenging as they juggled the operation costs of their businesses. According to the July Chamber of Commerce survey, about two-thirds of PPP recipients are now concerned with meeting the eligibility for PPP forgiveness.

Are Small Businesses Closing?

In short, small businesses are closing at an alarming rate. There have been articles warning this would happen due to the sharp decline in revenue most small business owners experienced this year. According to the American Bankruptcy Institute, there have only been about 800 small businesses that have filed for Chapter 11 bankruptcy. Yet, Yelp reports over 80,000 businesses that have closed between March and July. The majority of small business owners are concerned about permanently closing their businesses, and even with the help of PPP loans, small business owners are struggling.

How Does Small Business Failure Affect Future Business Financing?

Many small businesses are quietly closing and avoiding filing for bankruptcy. The SBA reports that businesses have a 24% higher chance of being denied a loan after having a bankruptcy on their credit report. Bankruptcy typically doesn’t help small businesses in the same way it benefits larger companies. This is because many small business owners are debt-averse and avoid having large lines of credit or loans in the first place. So, many business owners are simply shutting up shop and hoping to try again in the future.

Funding Without Debt

There are options for business funding that do not involve debt and won’t impact your credit score negatively. Invoice factoring is a financing solution for businesses selling to other businesses on credit terms. Factoring works by accelerating cash flow through unlocking working capital that is owed to a business. Basically, once you make a sale, you can have immediate payment on your invoice rather than the typical 30 or 45 day credit terms.

How to Protect Your Small Business Cash Flow

When it comes to protecting your business during COVID-19, you have to consider your cash flow in your funding decisions. If you have already taken a PPP loan, you may need a second round of funding. Hopefully you met the criteria for PPP forgiveness, but if you have to repay the PPP loan amount, it is not the end of the world. Factoring is a great cash flow tool you can use to protect your business right now. With this wave of small business closures, you have to be vigilant about the credit you grant to customers. If your largest customer closes, will your business follow? Factoring services provide an additional layer of credit protection. The experts at Eagle Business Credit can provide insight and give your business warnings about potential customer non-payment. There are many small businesses closing right now. Your business doesn’t have to be one of them.