As a small business factoring company, we encourage potential clients to send us their invoices and share how they tackle the invoicing process. Even if we don’t land the client because they don’t need better cash flow at the moment, it’s a mutually beneficial process. Why? Because a fresh set of eyes can shine a light on the gaps in your business. Typically we notice the gaps in cash flow that is due to invoicing and late paying customers, but this logic can apply all throughout your business. Where are the gaps in your small business performance? Are you removed enough to see them?

Credit Management

If you’re selling to other businesses on credit terms, more than likely you have some gaps in your credit management. Whether you extend the majority of credit to one customer, or whether you have a diverse portfolio solely consisting of late paying customers, there will be improvements to make in this area. That’s only because credit management is a time-intensive task that often small business owners lack the time to accomplish. I’m not blowing smoke. In a recent survey, more than one-third of treasury employees admitted to not having enough time in their work day to accomplish all their tasks. That’s an alarming statistic. Poor credit management leads to fraud, late payments, or no payments at all. These three things to avoid could all lead to business failure. Good credit management processes lead to better cash flow. And as we all know in business, cash flow is king.

Diversification

If one industry takes a dip, do you have enough clients in other industries to support your business? How about if one customer takes a dip? Again, you don’t want to expose your business to credit risk by concentrating credit with only one or two large clients. Further still, if you have customers that pay at 60 days consistently, do you have enough customers that pay sooner? Will you be able to cover your business expenses with net 60 terms? Diversify your customers to protect your business from credit risks and from industry peaks and dips.

Plan for Surprises

If business was smooth, everyone would be an entrepreneur. Running your own business comes with risks. Plan to lose clients–whether the reason is due to an economic downturn, their own bankruptcy, or a competitor. Create a contingency plan for these situations. If your largest client went under today, how would your business fare tomorrow? What course of action can you take today to prevent loss tomorrow? These are the questions you must ask yourself. Prepare for the worst but hope for the best. When these surprises hit your business, you won’t suffer because it is within line of your plan.

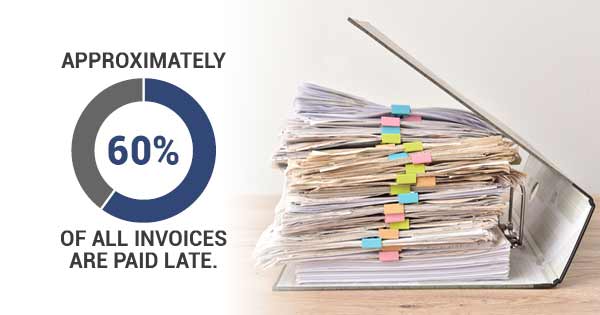

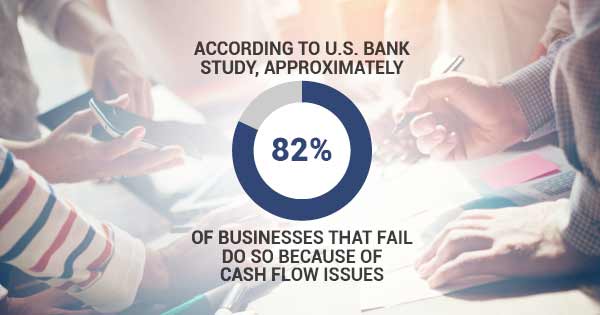

Cash Flow Gaps

You will have a gap in cash flow. Small businesses disproportionately see cash flow problems. This is due to larger firms utilizing their market power to set extensive credit terms with their suppliers. Without the market power of a Fortune 500 company, your business probably cannot do that. There are costs that you see every month: payroll, office space, general operating costs. There are also costs that may surprise you. Running low on available working capital can stall your growth or even end your business if you don’t have the strength of cash flow to cover these surprise costs.

How to Fill the Gaps in Your Business:

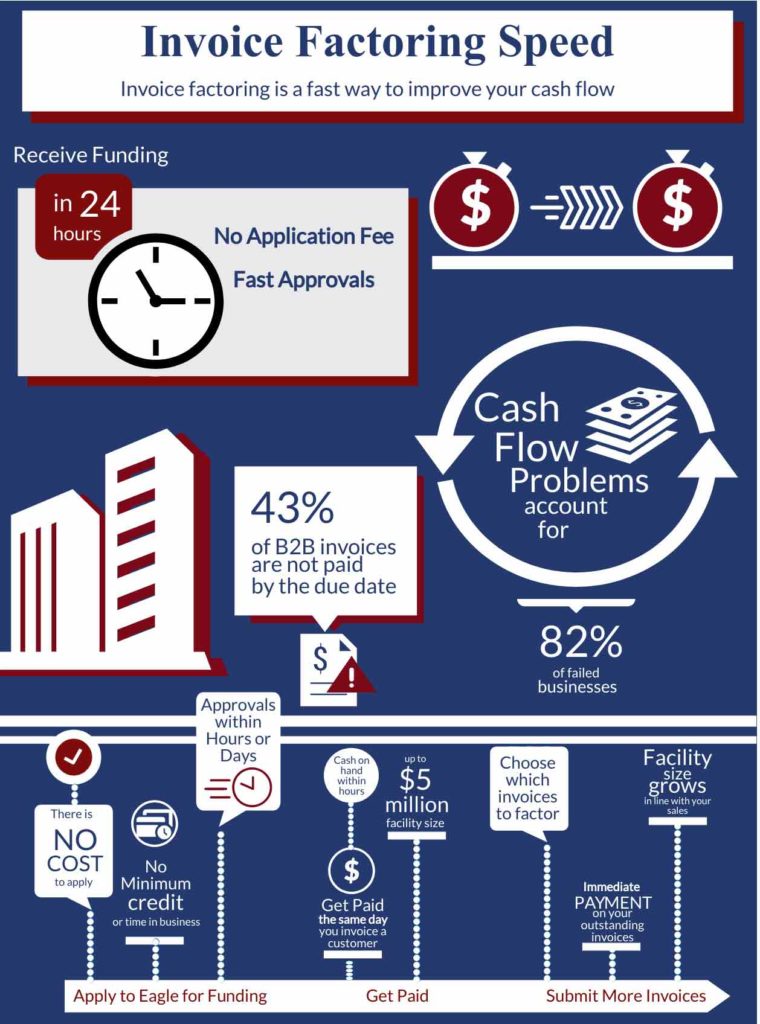

Let’s say you pinpoint the weaknesses in your business. Your credit portfolio is all over the place. Your cash flow could be better. You lack a method in place to cover surprise business costs. Now what? You can renegotiate terms with your clients. This process may be labor intensive, but you would rather be paid faster to close the cash flow gap and be able to cover your expenses. If a client cannot pay you sooner than the existing terms, there are other options for your business. You don’t have to drop a client. Consider partnering with a business financier. Invoice factoring is just one example of filling the gaps in your business. Invoice factoring services include immediate payment on your open invoices, credit monitoring, receivables management, and better cash flow. The common areas that will show your gaps in your business is where a factoring company serves.

A Fresh Set of Eyes

Put a fresh pair of eyes on your business. This can be a CPA, a financial underwriter, or a factoring company like Eagle Business Credit. These professionals know what to look for in your business. They will spot the gaps in your operation that can hurt you financially. Additionally, you can identify sources of business funding during this process. It’s best to know how fast you can access financing, how long the application process takes, and what your management team needs to secure a mutually beneficial financing method.

Give us a call at Eagle. We can recommend best practices for invoicing. We can spot a client that will pay late or potentially not pay at all. We can improve your cash flow by injecting cash immediately into your business. All of this comes at little cost and saves you time in administrative and accounting processes. The gaps in your business will be evident in your financials. Whether there are late payments, lengthy credit terms, or thin margins, we can offer professional advice on filling these gaps all at no commitment and no cost to your business. If you choose to move forward and factor your invoices, the application process can be completed in typically 1 to 3 business days. Your access to cash is the same-day as your first submitted invoice. There is no waiting for your cash, and there is no waiting for your business growth.