Working capital management reflects a company’s financial health. Sales could be up, but how can a small business continue to operate without enough available working capital to purchase more supplies, distribute the goods, or meet payroll? Money tied up in accounts receivable can kill a business faster than having a bad product. This is why it is so important to manage working capital for a small business.

Importance of Working Capital

Working capital itself is the difference between a small business’ assets and liabilities. This means deducting accounts payable from a business’ cash, inventory, and accounts receivable. Although this number could be much higher than a company’s debts, having too much money tied up in accounts receivable can hurt a business. Having to wait the 30 to 90-day credit terms to collect payment could mean turning down sales, delaying payroll, or taking out high-interest loans.

Importance of Working Capital Management

Balancing assets and liabilities with the available capital to continue growing your business is hard. Extending credit terms to clients is expected when selling B2B, and these credit terms can cause a capital shortfall between sale and payment. There are only so many items in the budget you can slash to free up working capital for operational costs.

What Is Important of Working Capital Management?

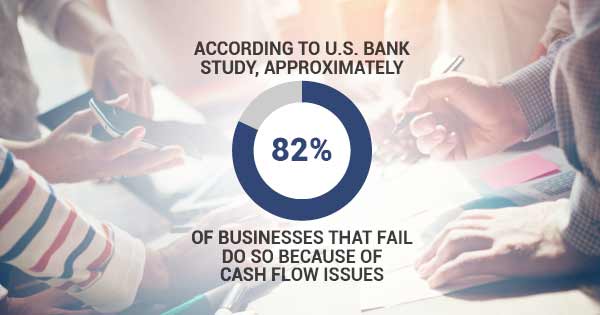

The 3 Main Strategies of Working Capital Financing share a common principle: liabilities should not be higher than assets. In simpler terms, the business should be getting paid more than they owe. If working capital management is this simple, why do 82% of failed businesses cite cash flow as a contributing cause? Each working capital management strategy carries its own risk:

-

Conservative Working Capital Management: low-liquidity, relies on long-term financing, and allots more in assets than liabilities at the cost of financing interest-rates

-

Aggressive Working Capital Management: little to no cushions for a change in working capital needs. Assets are maintained only to meet liabilities. This means maximum production capacity in theory, with no room for error or variation in business

-

Matching: financing long term assets with long term financing and short-term variations with short term financing. Inventory kept to a minimum and early payment discounts offered

Working Capital Financing Strategies

Eagle Business Credit offers working capital funding to small businesses. Our invoice factoring services offer a cushion to companies with conservative, aggressive, or matching working capital management strategies. Growing businesses, seasonal businesses, or startup businesses could all benefit from invoice financing to boost cash flow, lower risk of insolvency, and scale the business.

The Importance of Factoring In Working Capital Management

Invoice factoring is a working capital financing solution that is debt-free and customized to fit your financing needs. Whether a business invoice $20,000 a month or $2,000,000 a month, invoice factoring fits the financing needs between sale and payment. This is why factoring is so important to working capital management. The flexibility and speed of funding enables business growth indefinitely. Why wait to get paid?