82% of failed businesses cite insufficient cash flow as a cause. This means that there are periods where the business does not have enough money to cover payroll, supplies, overhead, etc. Typically, this is found in growing businesses. Expansion requires a lot of money to cover upfront costs like product development, new office space, new hires, and supplier costs. A lot of businesses see their working capital tied up in accounts receivable with 30 to 90 day credit terms. This is where working capital loans can help improve cash flow to support small business expansion.

- Breaking Down the Components of Working Capital

- Estimating Working Capital Requirements

- Working Capital Management

- Working Capital Financing Strategies

- Qualifying for a Working Capital Loan

- Factoring Loans for Working Capital

- Considering Online Working Capital Loans

- The Difference Between Receivables Funding and Working Capital Loans

- FAQ with Working Capital Financing

- Pros and Cons of Working Capital Loans for Small Businesses

The Components of Working Capital

First, let’s look at the various components of working capital. What is working capital? Basically, working capital is the difference between your assets and liabilities at any given time. This gives you an idea of your profit during a given operating cycle.

Further than looking at overall profit, you have to look at the timing and liquidity of your assets and liabilities. For instance, your inventory and equipment will be less liquid than your cash on hand. Even further, your open invoices will require sometimes upwards of two months before you have payment. With less flexible liabilities, like payroll or taxes, you may find yourself without enough available working capital to cover them.

How to Estimate Your Working Capital Requirements

When analyzing your working capital needs, it’s important to consider the timeliness of your payments due versus your open receivables. Will your business have the necessary working capital to cover the fixed costs of business? It’s common to extend credit terms to other businesses. This can mean damaging your cash flow if you are not getting paid for 30 to 90 days after making a sale. This plays into estimating your needs for working capital. What does your monthly cash flow picture look like?

Understand your operating cycle and how your assets and liabilities work within that period. Add your inventory and accounts receivable cycle days together. Healthy cash flow means your accounts payable cycles are longer than that. It is not uncommon for new or growing businesses to use working capital funding to close the gap in payables and receivables during their operating cycle.

Working Capital Management

Managing your working capital without financing methods can be tricky. After analyzing your company’s working capital requirements and cash flow cycle, there are several areas to monitor. The first is your Days Sales Outstanding. How long is it taking for your clients to pay for your goods or services? Typically, larger companies with greater market share can extend their payment terms to 90+ days. This is itself a working capital management strategy. If you don’t have the same power in the market to demand these payment terms to your own suppliers, you can owe more money than you have on hand.

The second area to examine is your accounts payable. What are the credit terms you agreed upon with your suppliers? Extending these term lengths can help with the amount of working capital you have on hand and ready to use. If not, your vendors may offer a discount for early payment. It doesn’t hurt to ask.

Next, consider offering a discount of your own to your clients for early payment. Early payment for your open receivables can mean the difference between covering your fixed costs like overhead and payroll versus missing these and having a lawsuit on your hands.

Last, if you still need more money to grow your business, there are business financing methods that specialize in increasing working capital and improving cash flow. We offer invoice factoring, which is a debt-free business financing strategy that gives small businesses the working capital needed to expand into new products, locations, or teams.

Working Capital Financing Strategies

There are lots of options for working capital financing, and it can be challenging to find the best option for your business. There are three aspects of your financing method that you must examine: quality, speed, and cost.

Is your working capital financing strategy of high quality? Is your lender experienced in your industry? How is their customer service? Is there room for growth potential? These all factor in to the overall quality of your financing strategy.

How quickly will you have access to your business financing? If you need immediate financing, you may be eligible for an online loan or an MCA, but at what cost? Fast business funding is a major benefit to your strategy but take the time to examine the conditions for any hidden fees or penalties. You don’t want to go with the fastest lender that will charge you an arm and a leg.

Last, how much will this financing cost you? Are you paying reasonable prices for a long-term loan? Are you paying as high as triple digit APRs for an MCA? Choose the financing method that allows for your business to grow and expand for long-term profit.

Read more detail about specific strategies of working capital financing here:

Qualifying for a Working Capital Loan

There are endless lenders that offer working capital financing. Searching for working capital loans online yields pages and pages of results. The important thing is to find the lender that gives your business the best benefits. Yet, it can be hard to be selective when you own a new business or have poor business credit. Most traditional methods of working capital loans like a bank loan or SBA loan will require years in business, a high business credit, and a high personal credit.

Ian talks about debt-based financing in the video below.

For new-start business owners or entrepreneurs with a less than perfect credit history, the options can get expensive. Many online lenders boast that their approvals are generous, but many online loans use algorithms in the underwriting process. This means that you may be approved for financing, but most likely you won’t find the loan amount you want or the APR you want.

Being able to build business credit and enough time in business to qualify for an inexpensive financing method can mean turning down growth opportunities at the start of your business. Can your business afford to wait two years before seeking rapid expansion?

Finding a working capital loan that will not damage your cash flow due to repayment terms or costs is crucial, especially when collateral is involved. If you default on your expensive term loan, is your house at stake? Debt-based financing is a risky game. One of the benefits of our invoice factoring services at Eagle is that there is no repayment to make. It’s debt-free business funding because the money is already yours.

Read more about qualifying for working capital loans here:

Factoring Loans for Working Capital

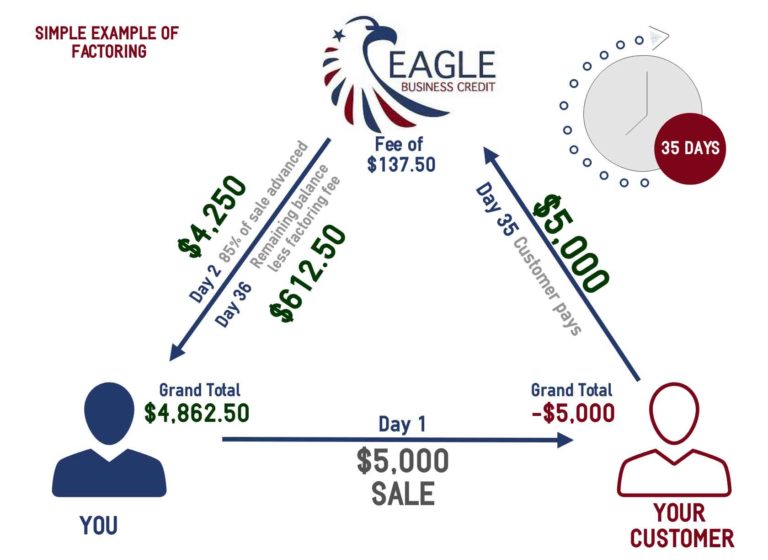

Now the phrase “factoring loan” is a bit misleading. Invoice factoring is business financing, but it is not a loan. There is no debt on your balance sheet, and the money is yours. It’s simply an advance on your open receivables. Factoring loans are well-suited for companies that sell on lengthy credit terms. Upfront payment for your goods or services unlocks your working capital from your receivables and accelerates the cash flow cycle.

In this episode of The Money Factor, our CEO Ian discusses the different ways to finance your working capital. Watch below!

Online Working Capital Loans

So when it comes to online loans, it’s faster and easier to get established. Usually there is less paperwork involved because of FinTech and the process is streamlined for the on-boarding comfort of the applying business. This isn’t a statement that applies to all online lenders, but typically online lenders have easier loan application processes than banks.

The price of online term loans can be more expensive than a bank, and repayments can be automatic withdrawals from your account. APRs range from 10% to 400%. It is up to an algorithm to determine the worth of your small business. Repayments are daily, weekly, or monthly depending on the terms of your lender, and this can damage cash flow.

To read more about online working capital loans, click here.

The Difference Between Receivables Funding and Working Capital Loans

Whereas working capital loans require collateral or a guarantee, receivables funding uses your open invoices as collateral. This makes receivables funding a major benefit to small businesses without enough collateral to put up for larger amounts of capital. Advanced payment on your open invoices means having the cash flow to expand operations rather than waiting for loan approvals.

Additionally, receivables funding is a revolving line of credit for your business. This means that there is no need to seek re-approval for additional amounts of funding. Instead, your business has a steady financing solution that improves your cash flow continuously.

To read more about receivables funding versus working capital loans, click here

Frequently Asked Questions with Working Capital Financing

What is working capital financing?

Working capital financing is finding a funding solution that increases your available working capital. This can be used to fuel business growth, cover operating costs, or meet payroll.

How do I qualify for a working capital loan?

Working capital loans come in all shapes and sizes. An MCA has low requirements yet should not be a first option for working capital financing. Whether you have time in business or a high credit score, an online working capital loan will be more expensive than a traditional bank loan. If you are looking for a fast, flexible working capital financing solution that will improve cash flow without costing an arm and a leg, invoice factoring has low requirements. Instead, approvals are based on the quality of your customers and product.

How do I get more access to working capital?

Ian Varley discusses additional working capital financing even if you have a line of credit or loan in place. Watch below!

For more frequently asked questions and answers to working capital financing, click here!

Pros and Cons of Working Capital Loans for Small Businesses

Working capital loans have a lot of benefits to small businesses looking to improve their cash flow. Unlocking your working capital tied up in long or short term assets means having the cash injection to fuel business growth. What are the cons involved in seeking working capital loans?

See Ian discuss how to find quick business funding below!

It can take time to find the right financing solution that fits your business needs. This is where an invoice financing broker can help you find the right working capital financing solution. Another area to watch is your credit score. Some online loans advertise not pulling credit upon application, but they can do a hard pull of your credit upon first funding. Be wary of how your working capital loan solution will affect your business or personal credit.

For more pros and cons of working capital loans for small businesses, click here!

Working Capital that Grows with Your Business Needs

That’s the guide to working capital and the importance of working capital financing. There are a lot of options out there, and invoice factoring is one of them. If you sell to other businesses on credit terms and have working capital tied up in your open receivables, it is a great option to explore. If you need help finding the right working capital financing solution for your business, give us a call. We can help your business find the right financing partner for your business.

Get Started

Today

Curious about how invoice factoring can help your growing business? Improve your cash flow today to sustain your rapid business growth!