Online loans are an alternative financing method for small business owners. AR Funding (also known as Accounts Receivable Funding) is a business financing method that advances cash on your open receivables. When comparing online loans to AR Funding, it is important to compare the amount of funding, the cost of funding, and the time it takes to get funded. Both of these funding options are alternative financing methods to traditional bank financing. Many business owners find themselves comparing online loans and AR financing to decide which is the right financing method for their business needs.

Time for Online Loan

One of the advantages of online loans is that they often offer a streamlined application and funding process, allowing for faster approval and disbursement of funds compared to traditional bank loans. In many cases, online lenders leverage technology to automate various stages of the lending process, which can expedite the timeline.

Typically, the time frame for online loan funding can range from a few days to a couple of weeks. Some online lenders may provide instant or same-day approvals, with funds deposited into the borrower’s account shortly after approval. This is particularly true for smaller loan amounts or lines of credit.

For larger loan amounts or more complex loan products, the process may take a bit longer. The lender may need additional time to review the application, verify documentation, and conduct underwriting or credit checks. It’s not uncommon for the funding process to take up to a few weeks in these cases.

It’s important to note that each online lender may have its own specific timeline for processing loan applications and providing funding. It’s advisable to research and compare different online lenders, read customer reviews, and review the lender’s website or contact their customer support to inquire about their typical processing times.

Additionally, the time it takes to receive funding may also depend on the borrower’s responsiveness in providing any requested information or documents and promptly completing the required steps in the application process. Being proactive and promptly fulfilling any requirements can help expedite the funding timeline.

Time for AR Funding

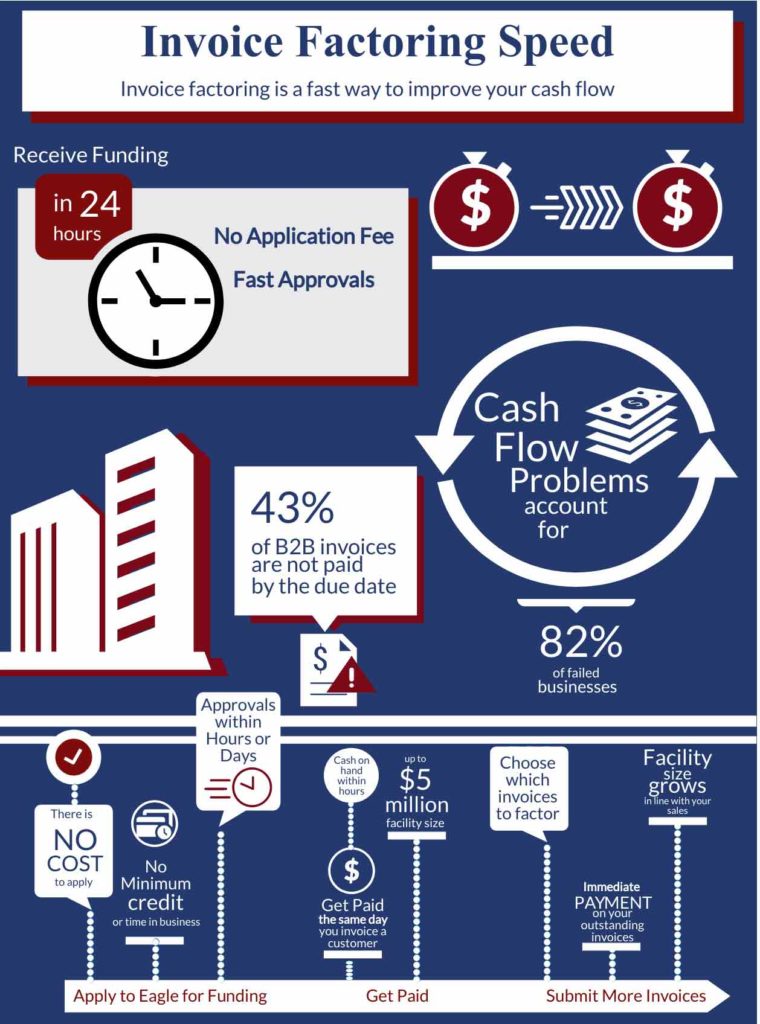

Generally, AR Funding can offer relatively quick access to funds compared to traditional bank loans. Once the application is submitted and the necessary documentation is provided, the funding process can typically be completed in a matter of days.

The specific timeline for AR Funding can be influenced by the time it takes to gather documents, so the faster you submit documents to the lender, the faster they can review your application. AR Financiers evaluate different documents than banks or online lenders, so this could take less time.

It’s important to note that different AR Funding companies may have varying processes and turnaround times for approvals. Some companies specialize in providing quick funding and may have more efficient processes, while others may have longer processing times. Eagle can typically provide applicants approval decisions within a week or even in one day.

Cost of Online Loan

Online business loans are typically offered by alternative lenders, fintech companies, or online platforms, and they may have different pricing structures compared to traditional bank loans.

Here are some common components of the cost:

- Interest Rate: Online business loans often have higher interest rates compared to traditional bank loans due to the increased risk associated with lending to small businesses or borrowers with less-established credit histories. The interest rate can be fixed or variable and is typically expressed as an annual percentage rate (APR).

- Origination Fees: Some online lenders charge origination fees, which are upfront fees based on a percentage of the loan amount. These fees are typically deducted from the loan proceeds, meaning they reduce the amount of funding received by the borrower.

- Processing Fees: Online lenders may also charge processing fees, application fees, or other administrative costs associated with reviewing and processing the loan application. These fees can vary in amount and may be either a percentage of the loan amount or a flat fee.

The specific costs of online business loans can vary significantly depending on the lender and the borrower’s individual circumstances. It’s important for business owners to compare loan offers from different online lenders, review the terms and conditions, and consider the overall cost of borrowing, including interest rates and fees.

Cost of AR Funding

The cost of AR Funding is based on the invoice amount. AR Funding works by advancing payment on open invoices that are paid on credit terms. Eagle typically costs 2-4% of the invoice amount. This means that a business gets instant payment on their open invoices and pays only 2 to 4% of the invoice amount for better cash flow.

The specific cost of an AR Funding agreement will depend on the quality of invoices and quality of customers. Customers with strong credit history will look better to AR Funders than customers that don’t pay on time or pay reliably.

Amount of Online Loan

Online business loans often range from a few thousand dollars to several hundred thousand dollars. The specific loan amount depends on factors such as the borrower’s revenue, credit history, business plan, and the lender’s policies.

Online lenders often cater to small and medium-sized businesses that may have difficulty accessing traditional bank loans. It’s important to note that the loan amount will depend on the individual circumstances of each business, including their financial needs, creditworthiness, and the lender’s evaluation.

Amount of AR Funding

The amount of funding available to you from AR Funding is based on the invoice amounts that you submit. The more sales you make, the more funding will be available to you. Since AR Funding does not require a high credit score, more funding may be available to new or growing businesses that otherwise would not receive their full loan amount from other lenders. Eagle offers funding lines up to $5 million.

Which Funding Method Is Right for Your Business?

Each business owner must decide which funding method is right for their business needs. AR Funding is a financing option that enables business growth and grows in line with a business’s needs. Online loans can be easier to qualify for than traditional bank loans but watch out for cost. So, business owners should research and talk to lenders to find out the right fit for their business.