Factoring often gets a reputation for being an expensive method of business finance. Bank loans are typically the least expensive option for business funding, if you have the right credit and financial statements. Online lenders and merchant cash advances report high approval rates but similarly high interest rates. According to the 2017 Small Business Credit Survey, 44% to 90% of small businesses reported financing shortfalls due to insufficient credit histories and collateral.

What is the Cost of Working Capital Funding?

At Eagle Business Credit, we pride ourselves on offering flexibility in our working capital funding strategies. There is no one-size-fits-all solution to small business funding because each small business has unique financing needs. Our fees are transparent and start as low as 1%. Typical rates fall between 0.5% and 3.00%. When you sell your receivables to Eagle Business Credit, you have the immediate working capital to grow your sales. The factoring fee we charge is outweighed by eliminating the hassle and wait-time of the collections process.

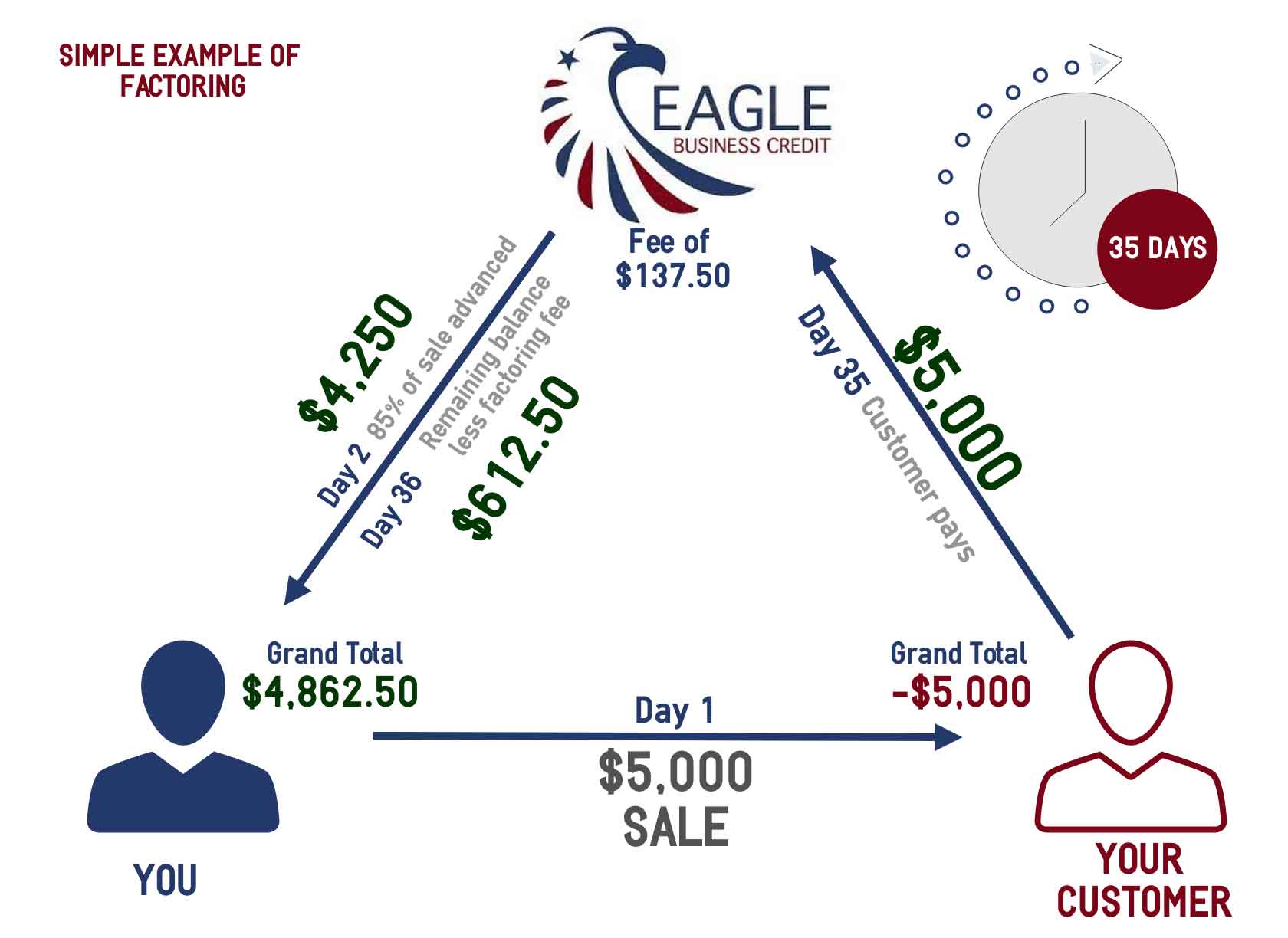

Here is a breakdown of the cost of factoring:

-You make a sale of $5,000

-Eagle Business Credit immediately advances you $4,250 (85% of the invoice value)

-We collect from your customer (they pay on day 35)

-We keep a fee of $137.50 at a 2.75% rate

-We pay you the remaining $612.50

Invoice factoring does not require collateral, a personal guarantee, or repayments. We collect from your customers, not from you. Included in our factoring services at no additional charge is a team of finance professionals, dedicated to your company’s success. Free credit checks on your customers are offered, so you don’t have to worry about non-payment for goods or services, and you have 24/7 online access to your account. We use working capital funding strategies to make doing business easier and more efficient for our clients.

When the cost is outweighed by the opportunity created for your business, you can expand in any direction. Invoice factoring is a great funding solution for growing businesses. Unlike a line of credit, accounts receivable funding can extend with your growth. The limit of how much funding your business is eligible for is determined by the volume of your sales and quality of your customers. The more you sell, the more funding you can get. With the right factoring company supporting your company’s cash flow, you can focus on growing your business without stressing over the financials.

How expensive is your business funding?

Ian discusses invoice factoring as a funding option for your business. Compared to other alternative funding options, factoring stands out as a flexible funding solution that grows with your working capital needs. Watch below!