Take the right steps to ensure your business never runs out of money.

Managing cash flow is a critical aspect of running a successful business. It ensures that you have enough funds to cover your expenses, invest in growth opportunities, and weather any unforeseen challenges. Here are our top 5 tips on effective strategies to optimize your business cashflow, help maintain a healthy financial position and achieve long-term success.

1. Monitor and Forecast Cashflow:

To optimize your business cashflow, it is crucial to have a clear understanding of your current financial situation and future projections. Do you find you regularly have times of the month where money gets really tight, and you have to delay making payments? Do you dread dealing with payroll as you don’t know whether you’ll have enough funds available to cover it? Preparing a simple cash flow forecast doesn’t need to be complicated.

Using a spreadsheet, estimate your future monthly sales and when you are likely to get paid as it is the actual receipt of payment you need to use in the cash flow forecast. Then work out when you will be physically making payments and list out your other monthly obligations, including items like rent, payroll and taxes.

Like sales, there might be a “gap” between when you received goods from your vendors and when you need to pay for them based on the terms you’ve been given. Regularly monitor your cash inflows and outflows and use this data to create your cashflow forecasts. This will enable you to anticipate potential shortfalls or surpluses and help ensure you have the money available to cover your expenses when you need it or have some spare cash to use for additional investments.

#TheMoneyFactor Episode: 007 – How do you manage your cash-flow and expenses and maximize the value of your business

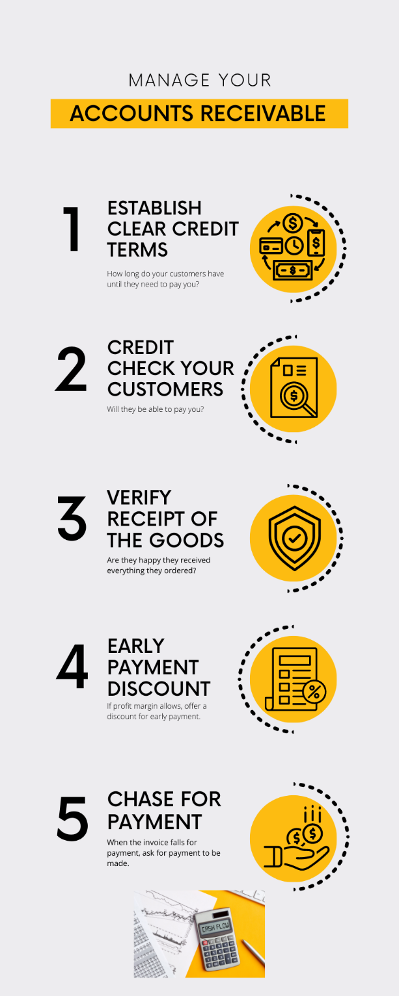

2. Manage your Accounts Receivable:

Efficient management of accounts receivable is key to maintaining a healthy cashflow. Afterall, if you don’t get paid for the sales you make, you will be out of business pretty quickly. To help minimize the risk of late, or even worse, non-payment, consider implementing some, if not all of the following A/R management strategies.

- Establish clear credit terms. How many days do you want your customers to take to pay you? Make sure your terms are in line with your industry standards and are not going to cause you an issue with paying your vendors. If you have to pay your bills in 30 days but you have allowed your customers to take 90 days to pay you are going to need to find a robust way to absorb that payment gap.

- Conduct credit checks on new customers. Who are they and will they be able to pay you? How long have they been in business? Do they have a history of late payments. Credit reporting agency reports like the ones produced by Dun & Bradstreet or Experian are expensive, but so can a large bad debt, so paying for one of these reports can be a good investment in the long run, but make sure you understand what it is telling you.

- You can also request bank or trade references as additional reassurance but bear in mind the trade reference needs to be from a reputable business and not the best friend of your potential customer. Bank references can be useful, but they will only be an indication of what the account balance was on the day the reference was given and not a commitment to pay at a later date.

- Verify the customer got their goods and they are happy with them. Immediately following delivery, check to make sure everything was received OK and there are no known issues. You don’t want to wait 60 days only to find out the invoice is on stop because they were missing one item, or the invoice amount is incorrect.

- If your profit margin can absorb it, encourage prompt payment from customers by offering discounts for early payments. Make sure you ask for this back if they take the discount but don’t pay you early.

- When the invoice falls due, make sure you ask for payment. You’d be amazed how many companies won’t send the check if they haven’t been asked for it. They probably have different obligations to meet, and limited funds available, so also need to juggle their cash flow to survive. To help the process, set up automated reminders that trigger a few days before the invoice is due and then again, a week or so afterwards if payment hasn’t been received.

3. Optimize Accounts Payable:

Just as managing accounts receivable is crucial, optimizing accounts payable is equally important. Negotiate favorable payment terms with suppliers, taking advantage of early payment discounts whenever possible. Always make sure you pay them on time. You don’t want to be charged extra or run the risk of future orders being delayed or refused.

4. Control Inventory Levels:

Excessive inventory ties up valuable cash that could be used elsewhere in your business. Older items may be harder to sell without heavily discounting, which is bad for both your profitability and cash flow if you can’t offset the price reduction with the original supplier (and how likely is that to happen?). Analyze your sales patterns and adjust your inventory levels accordingly.

If you are able to quickly source new product, use just-in-time inventory management techniques to minimize carrying costs and ensure that you have the right amount of stock to meet customer demand. There is no point having to pay for items you’ve bought before you have an order for them to sell to one of your customers.

5. Explore Financing Options:

In some cases, businesses may need additional funding to optimize their cashflow. Consider exploring financing options such as business loans, lines of credit, or invoice factoring. However, it is important to carefully evaluate the terms and interest rates associated with these options to ensure they align with your business goals and financial capabilities. Will they be sufficient to meet your medium-to-long-term needs as you grow?

A business loan might be a great option if you have some one-off expenses like purchasing some new equipment or buying another business, but it might not be a good solution for ongoing working capital needs once you have spent the cash it injected, leaving you with months or even years of loan repayments to make and no more funding to drawn on. A line of credit is a little better for your cash flow requirements, but if you are growing, the availability it once gave you may be restricted if you reach your facility limit and are unable to increase it.

Invoice factoring can be a great solution for new or growing businesses, but make sure you choose a reputable factoring company and understand all the fees that might be hidden in the contract. Factoring can also be a great help for a business as the facility often includes performing accounts receivable management like checking the creditworthiness of your customers and collection of invoices once they fall due. Some even include issuing invoices on your behalf leaving you free to do other things. These additional services could have significant value to you as the operations team working at the factor are experts at A/R management and have access to all those expensive reports so you won’t have to pay for them or understand what they all mean.

Optimizing cashflow is an ongoing process and is essential for maintaining financial stability and achieving long term success for your business. Regularly review your financial statements, cashflow forecasts, and key performance indicators to identify areas for improvement. Adjust your strategies as needed to adapt to changing market conditions, business growth, or economic fluctuations to ensure you have the right solution for you.

Eagle Business Credit gives you money for your business offering factoring and purchase order funding programs with a facility need of up to $5,000,000. Factoring works like a working capital line of credit by advancing immediate funds on invoices issued instead of having to wait to get paid, giving you the assurance you need you’ll have money available when you need it. There are no loan repayments to make as they get paid back by the customer when they pay their invoices.

For a no obligation consultation on what can be done for your business, call 855-420-8318 or schedule a time that works for you by clicking here.