In the small business world, particularly those selling to other businesses (B2B), working capital is the lifeblood that keeps operations running smoothly. Unlike cash sales, where payments are received immediately, B2B transactions often involve credit terms, meaning your business might wait weeks or even months to get paid. This delay in cash flow can create significant challenges if not managed properly. Understanding the importance of working capital and how to manage it effectively is crucial for the sustainability and growth of your business.

What is Working Capital?

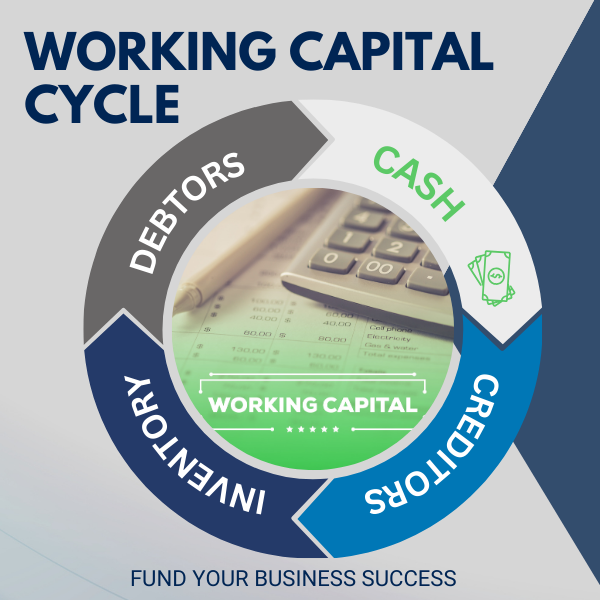

Working capital is the difference between your current assets and current liabilities. In simple terms, it’s the amount of cash available to meet your short-term obligations and fund your day-to-day operations. Current assets typically include cash, accounts receivable (money owed by customers), and inventory, while current liabilities include accounts payable (money you owe to suppliers), wages, and other short-term expenses.

For a small business operating on credit terms, working capital management becomes even more critical. The time lag between making a sale and receiving payment can strain your cash reserves, making it difficult to cover essential expenses like payroll, rent, and inventory purchases.

The Role of Working Capital in Business Operations

- Ensuring Smooth Day-to-Day Operations: Working capital is essential for maintaining the smooth functioning of your business. It ensures that you have enough cash on hand to pay for ongoing operational expenses, such as salaries, utilities, and inventory. Without sufficient working capital, even profitable businesses can struggle to meet these short-term obligations, leaving them unable to pay business critical expenses, ultimately leading to operational disruptions or even worse, business failure.

- Managing Cash Flow Gaps: In B2B transactions, extended credit terms are common. While this can make your offerings more attractive to customers, it can also create cash flow gaps. If your business has to wait 30, 60, or even 90 days to receive payment, you might find yourself in a cash crunch. Effective working capital management helps bridge these gaps, allowing you to maintain liquidity and continue operating without interruption.

- Supporting Growth and Expansion: Positive working capital provides your business with the flexibility to seize new opportunities for growth. Whether it’s taking on larger orders, expanding into new markets, or investing in new technology, having sufficient working capital allows you to make these investments without jeopardizing your financial stability.

- Handling Unexpected Expenses: Every business faces unexpected expenses from time to time, whether it’s a sudden repair, a tax obligation, or a downturn in sales. A strong working capital position acts as a financial cushion, enabling you to absorb these shocks without having to resort to expensive short-term borrowing or, worse, risking insolvency.

- Maintaining Good Supplier Relationships: Good relationships with suppliers are critical in a B2B environment. If your business consistently struggles to pay suppliers on time due to inadequate working capital, it could damage these relationships, leading to less favorable credit terms, higher process, or even supply chain disruptions. On the other hand, having sufficient working capital allows you to take advantage of early payment discounts and strengthen your supplier relationships.

Challenges of Managing Working Capital in a B2B Business

While the importance of working capital is clear, managing it effectively can be challenging, especially for small businesses operating on credit terms. Here are some of the key challenges you might face:

- Delayed Receivables: When you sell on credit, your cash is tied up in accounts receivable until your customers pay their invoices. If customers delay payments, it can strain your working capital and limit your ability to cover operating costs. This is why it’s crucial to monitor receivables closely and follow up on late payments.

- Inventory Management: Holding too much inventory can tie up valuable working capital that could be used elsewhere in the business. On the other hand, insufficient inventory can lead to lost sales and dissatisfied customers. Finding the right balance is key to maintaining adequate working capital.

- Supplier Credit Terms: While offering credit to customers can strain your working capital, it’s also important to negotiate favorable credit terms with your suppliers. Extended payment terms from suppliers can help ease the pressure on your cash flow, allowing you to better manage your working capital.

- Seasonal Fluctuations: Many businesses experience seasonal fluctuations in demand, which can impact cash flow and working capital needs. During peak seasons, you may need to invest more in inventory and labor, increasing the demand for working capital. Conversely, during slow periods, your working capital may be stretched thin due to lower sales.

Strategies for Managing Working Capital

To ensure your business has sufficient working capital to operate smoothly and grow, consider implementing the following strategies:

- Improve Receivables Collection: Implement strict credit control policies to reduce the risk of late payments. Consider offering early payment discounts to incentivize prompt payment. Regularly review your accounts receivable and follow up on overdue invoices to improve cash flow.

- Optimize Inventory Levels: Use inventory management techniques like just-in-time (JIT) inventory to reduce excess stock and free up working capital. Regularly analyze your inventory turnover to identify slow-moving items that can be reduced or eliminated.

- Negotiate Better Terms with Suppliers: Work with your suppliers to negotiate extended payment terms, which can help align your outflows with your inflows. Building strong relationships with suppliers can lead to more favorable credit terms and payment flexibility.

- Consider your Financing Options: If your business experiences regular cash flow gaps, consider an invoice factoring facility or working capital line of credit to bridge the gaps. While borrowing should be used judiciously, having access to ongoing reliable financing can provide a safety net during tight periods. A factoring facility will also help you to collect your receivables and help you with credit management decisions as part of their service.

- Regular Financial Monitoring: Continuously monitor your cash flow, working capital ratio, and other key financial metrics. Regular financial analysis allows you to identify potential issues early and take corrective action before they become major problems. Aim to have at least three months of readily available cash to help to cover any unexpected costs or reductions in revenue you may have not foreseen.

Conclusion

For small businesses selling to other businesses on credit terms, working capital management is not just a financial exercise; it’s a critical component of daily operations and long-term success. By understanding what working capital is and how vital it is to your business, anticipating challenges, and implementing effective management strategies, you can ensure that your business remains financially healthy, agile, and ready to seize growth opportunities. Remember, in the world of B2B sales, the strength of your available, liquid, working capital can make all the difference between thriving and merely surviving.