In recent times, the global economic landscape has been marked by unexpected shifts, and one such concern is the higher-than-expected inflation rate. As of the latest data from Forbes, inflation has surpassed initial projections, leaving businesses, particularly small enterprises, grappling with the repercussions. This surge in inflation can significantly affect small businesses — especially those relying on specific funding methods linked to interest rates and repayments.

Understanding the Inflation Surge

The current inflation rate has exceeded initial forecasts, reaching levels that haven’t been seen in years. This surge can be attributed to various factors including: supply chain disruptions, increased demand post-pandemic, and escalating energy prices. The Federal Reserve has prioritized inflation since 2022, increased interest rates aggressively in order to curb inflation, and now has stopped increasing interest rates as of July 2023. There are no immediate plans to cut interest rates with inflation remaining a top priority, and small businesses find themselves caught in the crossfire of officials trying to curb inflation.

Inflation’s Impact on Small Businesses

For small businesses, navigating the waters of inflation can be particularly challenging. Unlike larger corporations, small enterprises often operate on tighter budgets and have limited resources to absorb sudden increases in costs. The surge in inflation directly impacts operational expenses, ranging from raw materials and labor to transportation and utility costs. As these expenses soar, small businesses face the daunting task of maintaining profitability while avoiding drastic measures such as layoffs or price hikes that could alienate their customer base.

Funding Challenges Amidst Inflation

One critical aspect of small business operations is funding, and many rely on loans or a line of credit to survive and grow. Inflation, however, introduces a new layer of complexity to the funding equation — especially for businesses with financing methods that are intertwined with interest rates and repayments.

Interest Rates and the Cost of Borrowing

An immediate concern for small businesses is the impact of rising inflation on interest rates. As inflation climbs, the Federal Reserve may respond by adjusting interest rates, usually by hiking them. Interest rates reflect the cost of borrowing, and they directly influence the total amount a business must pay back in a debt-based financing agreement. Generally, a higher interest rate on a business loan will result in higher repayments. Small business owners that are reliant on loans or lines of credit may find themselves facing higher interest expenses, further squeezing their already tight profit margins.

Repayments and Debt

Additionally, the repayment of existing debts becomes a more substantial burden for small businesses in times of inflation. The real value of money decreases as prices rise, making it more challenging for businesses to repay their debts with the same amount of revenue. Small businesses may need to divert funds from essential operations to meet their repayment obligations, potentially hindering their ability to invest in growth or weather unforeseen challenges.

Adapting to the New Normal: Strategies for Small Businesses

In the face of escalating inflation and its impact on funding methods, small businesses must adopt strategic measures to navigate these challenging times. Here are some practical steps they can take:

- Evaluate and Adjust Budgets: Small businesses should conduct a thorough review of their budgets, identifying areas where costs can be trimmed without compromising essential operations. This may involve renegotiating contracts, seeking more cost-effective suppliers, or optimizing internal processes for efficiency.

- Diversify Funding Sources: Relying solely on loans with variable interest rates may expose small businesses to increased financial risk during periods of inflation. Exploring alternative funding sources, such as invoice factoring can provide a more stable financial foundation.

- Negotiate with Lenders: Proactive communication with lenders is crucial. Small businesses should engage in open discussions with their financial partners, exploring options such as interest rate adjustments, refinancing, or temporary relief measures to alleviate the burden of rising inflation.

- Explore Government Assistance Programs: Governments often introduce initiatives to support businesses during economic challenges. Small enterprises should stay informed about available assistance programs, grants, or subsidies that can help alleviate financial strain caused by inflation.

Funding Your Small Business Despite High Interest Rates

Inflation rates beyond initial projections present a considerable challenge for small businesses, affecting their operational costs and, consequently, their funding methods. The intertwined relationship between inflation, interest rates, and repayments requires small businesses to adapt and explore alternative funding methods that may be more insulated from interest rate hikes, like the potential benefits of invoice factoring.

The Role of Invoice Factoring

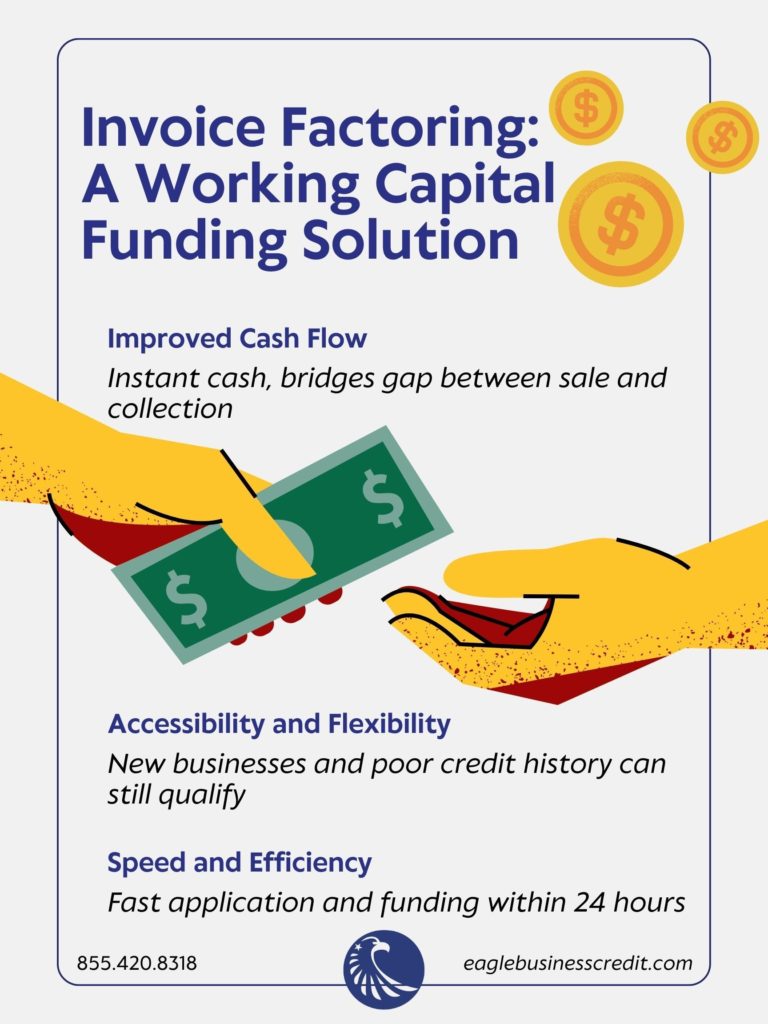

In the midst of these funding challenges, small businesses can explore alternative financing solutions to weather the storm of inflation. One such avenue is invoice factoring, a funding option that involves selling accounts receivable or invoices to a factoring company at a discount. This provides businesses with immediate cash flow, helping them bridge the gap created by delayed payments and outstanding invoices.

Advantages of Invoice Factoring:

- Improved Cash Flow: Invoice factoring accelerates the cash flow cycle by providing businesses with immediate funds, allowing them to meet operational needs and seize growth opportunities without waiting for customer payments.

- Mitigation of Credit Risk: The factoring company assumes responsibility for collecting payment from the customers, reducing the business owner’s burden of chasing down overdue payments and mitigating the risk of bad debts.

- Flexible Financing: Invoice factoring is a flexible funding solution that grows in tandem with a business’s sales. As sales increase, so does the potential for financing through factoring, providing a scalable and adaptive financing option.

- Debt-Free Funding: Unlike traditional loans, invoice factoring does not create new debt for the business. It leverages existing assets (accounts receivable) to secure immediate funding, making it an attractive option in times of economic uncertainty.

How to Overcome Surging Inflation

Invoice factoring can be a growth-enabling funding solution, offering improved cash flow, credit risk mitigation, flexibility, and a debt-free approach. By incorporating invoice factoring into their financial toolkit, small businesses can better navigate the challenges posed by surging inflation, ensuring resilience and sustainable growth in the face of economic uncertainties.