If you run a small business then you know how important working capital is. It takes money to make money, and you need cash on hand to expand your business. Being able to meet payroll, buy supplies, cover office space, and find new clients all requires strong working capital. There are several ways to secure working capital for a small business.

Ways to secure working capital for your small business

- Business Credit Cards

- Bootstrapping

- Crowdfunding

- Alternative Financing

- Bank Loan

Business Credit Cards

There are a few methods that small business owners turn to for working capital. Business credit cards is top of mind for many business owners. These typically have higher cash back rewards than personal credit cards, but similar to personal credit cards, you will want to pay your balance each statement. Credit cards are not known for having low interest.

Bootstrapping

Bootstrapping simply refers to paying your own way until your business can sustain itself. This can be risky and messy. As a business owner it is best practice to keep your finances independent of the business. This shields your personal assets from liability if your business was to go under. Bootstrapping is also very common for small business owners. While this may help you get up and running, it is not the most reliable source of securing small business working capital. Look for working capital funding sources that will enable growth and small business independence.

Crowdfunding

Crowdfunding is a short-term working capital strategy that is not scalable or sustainable over time. Do not rely on this method as your main source of working capital. There are uses for crowdfunding, but ultimately you should be seeking sustainable, long-term growth through the use of a funding partner that supports your business.

Alternative Financing

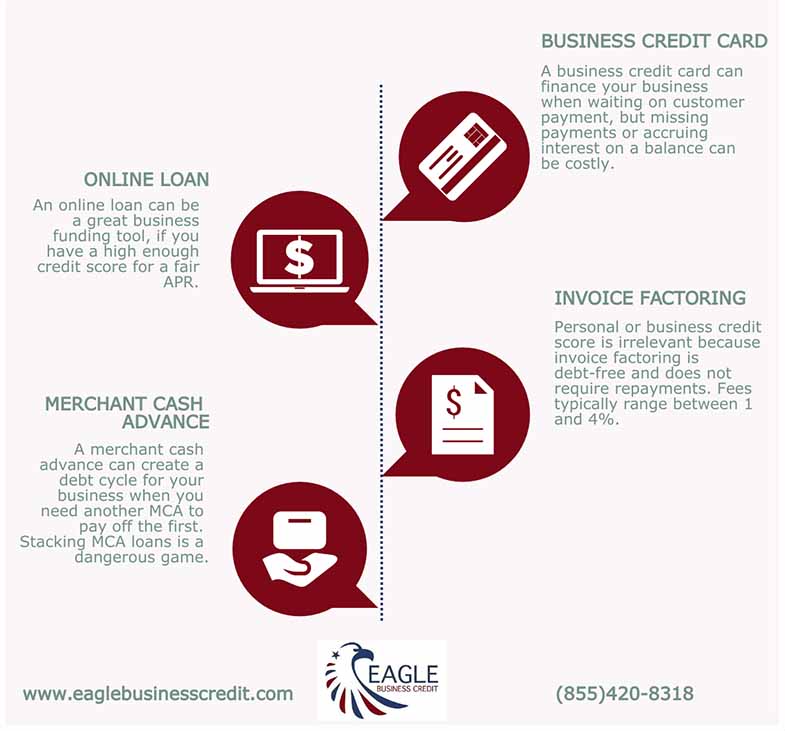

Alternative financing options include loans from online lenders, merchant cash advances, and invoice factoring. Merchant cash advances have made a name for themselves as being high cost and could lead to a debt cycle. Be wary of MCA lenders that offer a second or third MCA. This is known as MCA stacking and is not going to end well for your business.

Online loans can be great and easy for many small businesses. Be sure to understand what the loan will cost your business. These are often pricier than bank loans, but their qualification requirements can be lower.

Invoice factoring is a great funding options that improves working capital for small businesses. The qualification requirements are different than traditional financing, so this option is particularly helpful for businesses that are new or have insufficient credit criteria for loan approval.

Bank Loan

A bank loan is a great choice for securing working capital. Unfortunately for many small businesses, bank loans can be out of reach as a funding option or offer insufficient funding. Most bank financing will be a long-term growth strategy as long as a small business can qualify for the financing. Bank loans typically have more favorable costs but higher qualification standards. These standards can include minimum time in business, credit requirements, and collateral.

Secure Small Business Working Capital with Eagle Business Credit

Eagle Business Credit a factoring company in Metro Atlanta offers invoice factoring to small businesses. Eagle serves businesses across the country, and factoring services specialize in freeing up working capital to produce long-term growth.