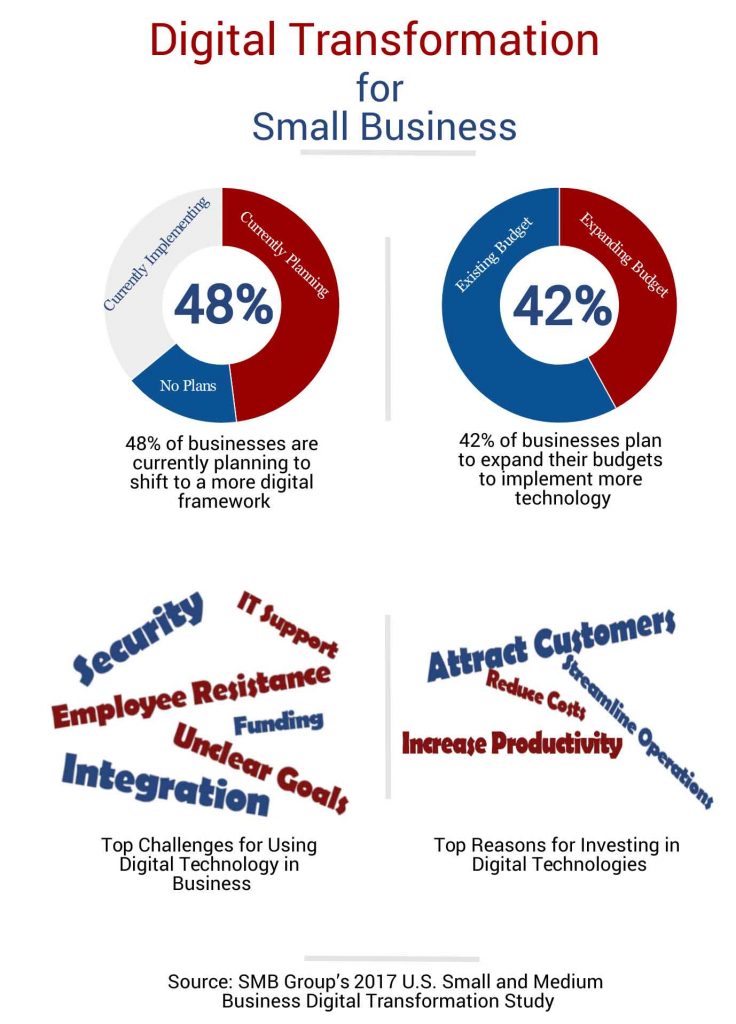

The SMB Group’s 2017 U.S. Small and Medium Business Digital Transformation Study shows nearly half, 48%, of businesses plan to shift to a more digital framework. In this context, digital transformation means increasing technology capability or usage in some capacity. This could range from simply integrating a chatbot on your website to migrating the whole of your internal systems to the cloud. Digital transformation is an ongoing process that business owners need to stay on top of, lest your competition stride ahead of you. With the increasingly important role that technology plays in the business world, it can be difficult to determine when and where to utilize technology in your operations. Here are some important questions to ask yourself throughout the digital transformation process.

Does it support your business goals?

Whatever piece of technology you’re eyeing, it needs to serve the core of your business. Will this technology ultimately help you reach your business goals? It’s easy to fall prey to jumping on the latest technology bandwagon because it’s cool or flashy, but will the addition streamline your workflow or complicate your process? Each step toward digital transformation in your business needs to reflect your core business goals and work toward improving the customer experience, otherwise what is the point?

Will you or your employees struggle with integration?

27% of business owners see their employees’ resistance to change as a top challenge for implementing new technology according to the SMB Group study. Address the reasons for moving to a digital solution, and address how their workflow will be streamlined or how customer experience will improve. If the whole office will be using the new technology, it may be worth your while to schedule a time to train everyone how to best implement it into their daily work schedules. Sometimes simple systems are better. After all, what’s the point of paying for expensive hard or software if it won’t be used to its potential?

Will the benefits offset the costs?

Fancy software may look appealing, but if your business doesn’t require all the features or bells and whistles, then what are you paying for? With 42% of businesses expanding their budgets to allot for technology costs, it is important to evaluate why and how technology will be used in your business. The Gartner IT Budget report of 2017 shows that healthcare companies spend almost 75% of their budget on IT and maintaining internal systems. Small businesses may benefit from using cloud technologies rather than maintaining internal systems.

Does it increase the customer experience?

Increasing profit is a common goal for any business owner, but are you sacrificing your customer to achieve that goal? Automation can take some workload off the shoulders of your employees, but will you lose customers over it? Introducing AI tools for data analysis allows your business to track trends and adjust accordingly. Replacing customer support channels with AI, on the other hand, may frustrate your consumer. Strive for more accurate analytics, faster communication tools, and streamlined operations at minimal to no expense of your customer.

Digital Transformation and an Invoice Factoring Company

Eagle Business Credit maximizes its implementation of technology without sacrificing the customer experience. FinTech and ongoing Digital Transformations afford customers account insight, efficiency, and direct access to finance professionals through multiple communication channels. With 24/7 online access, same-day funding, and outstanding customer service, Eagle Business Credit provides all-encompassing accounts receivable funding at the convenience of the client. Invoice factoring can provide the fast funding needed to support digital transformations, meet payroll, or sustain business growth.