It is a weird time right now to be a bank. News of bank failures like SVB and continued rising interest rates will affect the way banks lend money to small businesses. Banks are one of the primary sources of financing for small businesses, but they have strict qualification standards that make it difficult for some businesses to obtain loans. During economic downturns, bank lending slows as banks try to mitigate their risk. Banks see small businesses as riskier investments, so small business bank lending is usually harder to obtain. However, small businesses can still get a bank loan right now or in the near future.

What are the qualification standards for small business bank loans right now?

The qualification standards for bank loans to small businesses are designed to mitigate the risk that banks take on when lending money. Banks are in the business of making money, and lending money to small businesses is a risky proposition. Small businesses have a higher failure rate than larger businesses, and they are more vulnerable to economic downturns. If a small business fails to repay a loan, the bank may be left with a significant loss.

Bank Loan Criteria:

- Credit score

- Collateral

- Cash flow

- Time in business

To mitigate this risk, banks have developed strict qualification standards for small business loans. These standards typically include requirements for credit score, collateral, cash flow, and time in business. Small businesses that do not meet these requirements may find it difficult to obtain a loan from a bank.

Credit Score

Credit score is one of the most important qualification standards for small business loans. Banks use credit scores to assess the creditworthiness of a small business. A good credit score indicates that the business has a history of repaying its debts on time and is less likely to default on a loan. Small businesses with poor credit scores may be denied a loan or may be offered a loan with higher interest rates and more stringent repayment terms.

Collateral

Collateral is another important qualification standard for small business loans. Collateral is an asset that the bank can seize if the borrower fails to repay the loan. Banks require collateral to mitigate the risk of lending money to small businesses. Small businesses that do not have sufficient collateral may be denied a loan or may be offered a loan with higher interest rates and more stringent repayment terms.

Cash flow

Cash flow is also an important qualification standard for small business loans. Cash flow refers to the amount of money that a business generates from its operations. Banks use cash flow to assess the ability of a small business to repay a loan. Small businesses that do not have sufficient cash flow may be denied a loan or may be offered a loan with higher interest rates and more stringent repayment terms.

Time in business

Finally, business experience is another important qualification standard for small business loans. Banks prefer to lend money to businesses that have a track record of success. Usually banks like to see at least two years of successful business history. Small businesses that are just starting out may find it difficult to obtain a loan from a bank.

How can you get a small business bank loan right now?

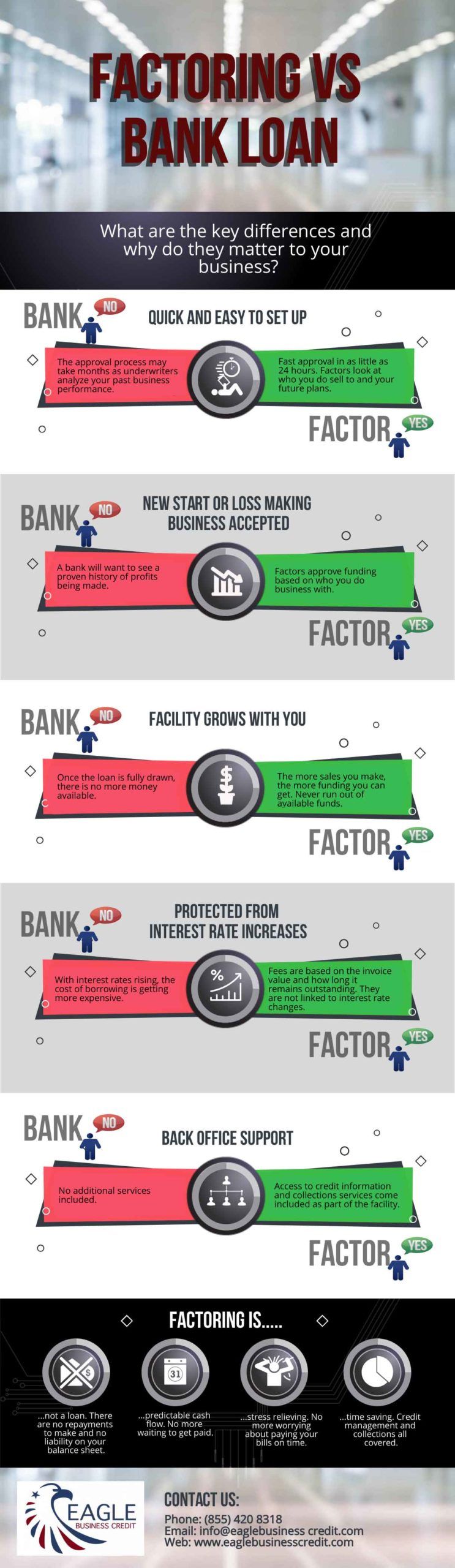

Since the qualification standards for bank loans to small businesses are rigid, small business owners need alternative funding sources. Banks require small businesses to meet strict requirements for credit score, collateral, cash flow, and business experience. Small businesses that do not meet these requirements may find it difficult to obtain a loan from a bank. Enter: invoice factoring.

What is invoice factoring?

Invoice factoring is when a factoring company purchases open invoices from a small business, providing the small business immediate cash. The factoring company will keep a percentage of the invoice amount (usually 2% – 4%) and wait the duration of credit terms before collecting directly from the customer. The benefit of factoring is healthier cash flow, increasing your credit score, growing your sales, and offloading bookkeeping duties.

How can factoring help you get a small business bank loan right now or in the future?

Invoice factoring has different qualification standards than bank financing. This means that new businesses, growing businesses, or businesses with poor credit can qualify for factoring. Then, factoring can help a business financially and get it into shape for a bank loan. Factoring targets cash flow, can improve credit, and can help a business grow over time. So, a bank may loan to a small business that has grown through invoice factoring.

Using factoring to increase credit score

A massive benefit of factoring is that it can increase a business credit score. How? Since a business will have more cash on hand, they can make payments to their creditors faster. Making early payments to a company that reports to credit bureaus will raise your credit score.

Factoring invoices to improve cash flow

Next, companies will factor their unpaid invoices in order to improve their cash flow. Cash flow refers to the money moving in and out of your business. Healthy cash flow means a company will have enough cash on hand to cover expenses and grow their business. Strained cash flow means a company may be waiting to collect on invoices and unable to make payments or investments until those invoices are paid. Poor cash flow can slow your business growth or lead to business failure.

Invoice factoring is designed to improve cash flow. This is the number one benefit of using factoring services. A small business is guaranteed to have immediate cash on hand after making a sale, and then, they can use that money to grow.

How can factoring increase your time in business?

Start ups can find bank financing difficult to achieve since many bank lenders want to see a year or two of business history. Starting and growing a new business is near impossible without financing. Factoring services can fund new businesses and help them grow and establish business history in order to meet bank qualifications.

Using invoice factoring as a small business

So, invoice factoring is a great solution for small businesses looking to grow. Further, many businesses use factoring in order to get a bank loan down the road. At Eagle, our invoice factoring services can fund small businesses of many shapes and sizes. Factoring is for a business to use in the interim to get a bank loan in a year or two, and factoring is for businesses to push their growth further despite cash flow strain. It is a versatile service that targets cash flow and creates financially healthier businesses.