Small businesses are the backbone of our economy, but many face significant challenges when it comes to managing their working capital. Insufficient working capital can hamper growth, limit opportunities, and even jeopardize the survival of a business. While traditional working capital funding solutions like bank loans may seem elusive for small businesses, there is a viable alternative: invoice factoring. In this article, we will explore how invoice factoring can address the pain points of small business owners who struggle with limited working capital and are unable to qualify for conventional funding options.

The Importance of Working Capital:

Working capital is the lifeblood of any business, representing the funds necessary to cover day-to-day operational expenses, meet financial obligations, and seize growth opportunities. It provides the necessary liquidity for inventory purchases, payroll, marketing efforts, and other crucial aspects of running a business. Insufficient working capital can lead to missed opportunities, delays in fulfilling orders, strained supplier relationships, and even business failure.

Pain Points of Small Business Owners:

- Limited Cash Flow: Many small businesses struggle with irregular cash flow, causing delays in paying suppliers, employees, or other bills. This can strain relationships and result in penalties, damaged credit scores, or even lawsuits.

- Inability to Qualify for Bank Loans: Small businesses often find it challenging to meet the stringent criteria imposed by banks for working capital loans. Factors such as limited operating history, insufficient collateral, and fluctuating revenues can make it difficult to secure traditional funding.

- Time-Consuming Application Processes: Applying for a bank loan can be a lengthy process, involving extensive paperwork, credit checks, and financial statements. Small business owners need quicker solutions to access the funds they need promptly.

Invoice Factoring as a Working Capital Funding Solution:

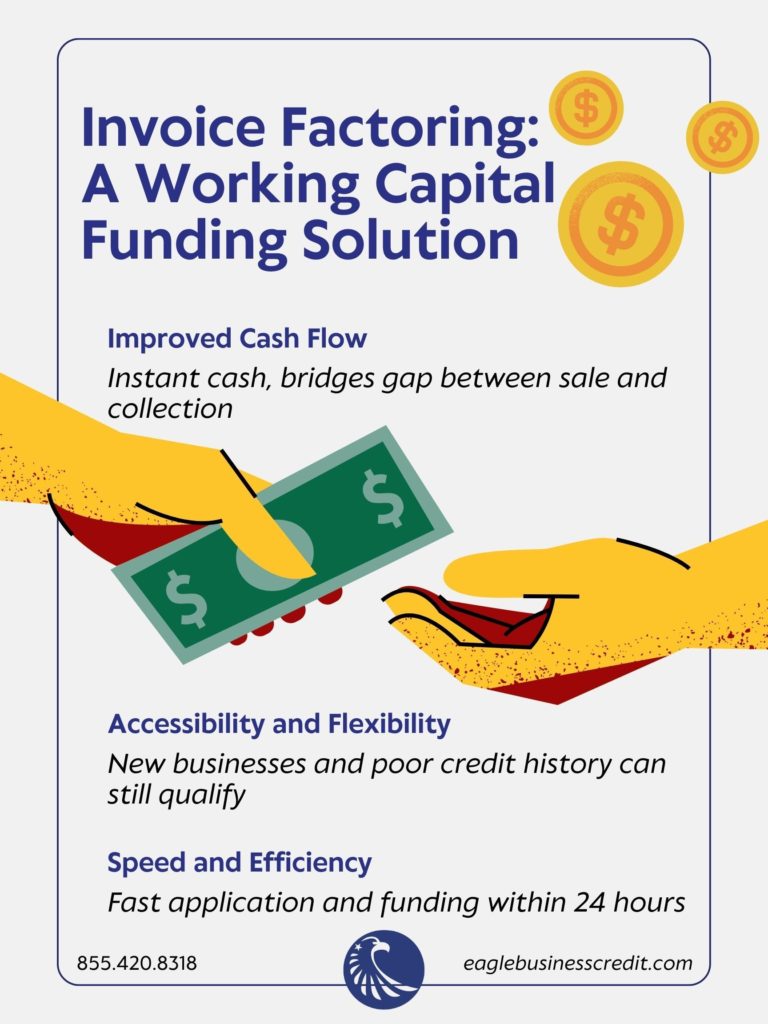

Invoice factoring offers a viable solution to small business owners who face working capital challenges. It involves selling unpaid invoices to a third-party financing company, known as a factor, in exchange for an immediate cash advance. The factor assumes the responsibility of collecting payment from the customers on the invoices, allowing businesses to access working capital quickly.

Working Capital Funding Solution Benefits of Invoice Factoring:

- Improved Cash Flow: By converting invoices into immediate cash, small businesses can bridge the gap between billing and payment cycles, ensuring smooth cash flow and enabling them to meet financial obligations promptly.

- Accessibility and Flexibility: Unlike traditional loans, invoice factoring is based on the creditworthiness of a business’s customers, rather than the business itself. Therefore, it is accessible to small businesses with limited operating history or weaker credit profiles. Factors also provide flexible funding, allowing businesses to choose which invoices to factor, providing greater control over their cash flow.

- Speed and Efficiency: The application process for invoice factoring is typically quick and straightforward. The focus is primarily on the creditworthiness of the customers rather than the business itself. This expedited process allows small business owners to access working capital solutions promptly, without the delays associated with traditional funding methods.

Invoice Factoring: A Working Capital Funding Solution

Small businesses often face significant challenges when it comes to managing working capital, leading to missed growth opportunities and potential business failure. Traditional working capital funding solutions like bank loans may be out of reach for many small businesses due to strict eligibility criteria. However, invoice factoring offers an alternative solution that addresses the pain points faced by small business owners. It provides quick access to working capital by converting unpaid invoices into immediate cash, improving cash flow, and allowing businesses to meet financial obligations promptly.

By leveraging invoice factoring, small businesses can overcome their working capital challenges, ensuring a stable financial foundation for growth and success. Whether it’s bridging the gap between billing and payment cycles, accessing funds without the need for strong credit profiles, or benefitting from a streamlined application process, invoice factoring proves to be an effective working capital funding solution for small businesses.

As the business landscape continues to evolve, small business owners can rely on invoice factoring to optimize their working capital and thrive in a competitive market.