If you run a small business, you know the challenges of having the cash on hand you need to be able to grow. Working capital is often tied up in inventory or accounts receivable. Unlocking the value of your open invoices is the specialty of invoice factoring companies. Invoice factoring can help grow your small business by providing you instant cash for your goods or services, eliminating the waiting period of selling on credit terms.

How Does Invoice Factoring Work?

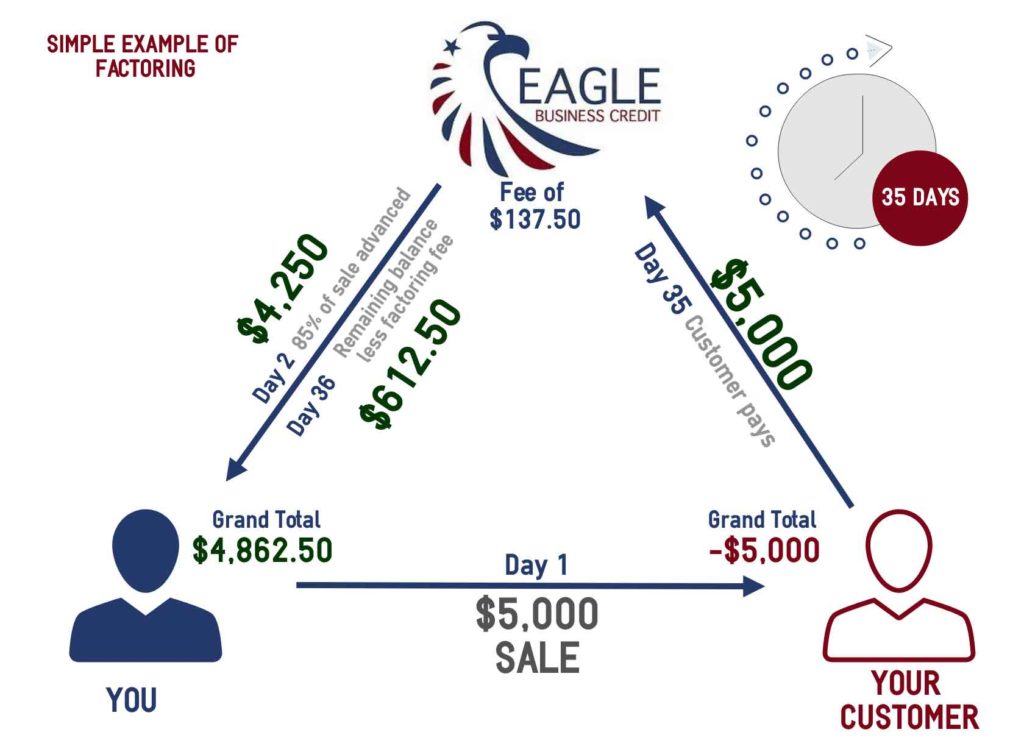

Invoice factoring for small business growth is simple. You run your business and make sales to customers. Once you invoice your customer, a factoring company sends you money for your invoice. Then, the factoring company waits the remainder of the credit terms to collect payment from your customer. There are some other components of factoring, but that is the broad stroke of it.

What Does Invoice Factoring Cost?

The cost of invoice factoring services will vary based on several things. These include: the strength of your customer, your product, the average time it takes for your customer to pay, etc. Typically, invoice factoring can cost between 2% and 4% of your invoice value. A factoring company will advance around 85% of the invoice amount instantly to your business. The rest of the money (less the factoring cost) will be released after your customer pays. A small business bank loan will be cheaper long term for your business, but factoring services can help business owners that do not qualify for bank financing or do not qualify for enough bank financing.

Is Invoice Factoring Right for Your Growing Small Business?

If your small business sells to other businesses on credit terms, chances are high that invoice factoring is a good growth solution for you. Eagle Business Credit is a factoring company that specializes in improving cash flow and helping business owners have the working capital to take on larger contracts. Invoice factoring is a great service to grow your small business. It is debt-free, easy to qualify, and will provide the cash on hand you need to have financial freedom.