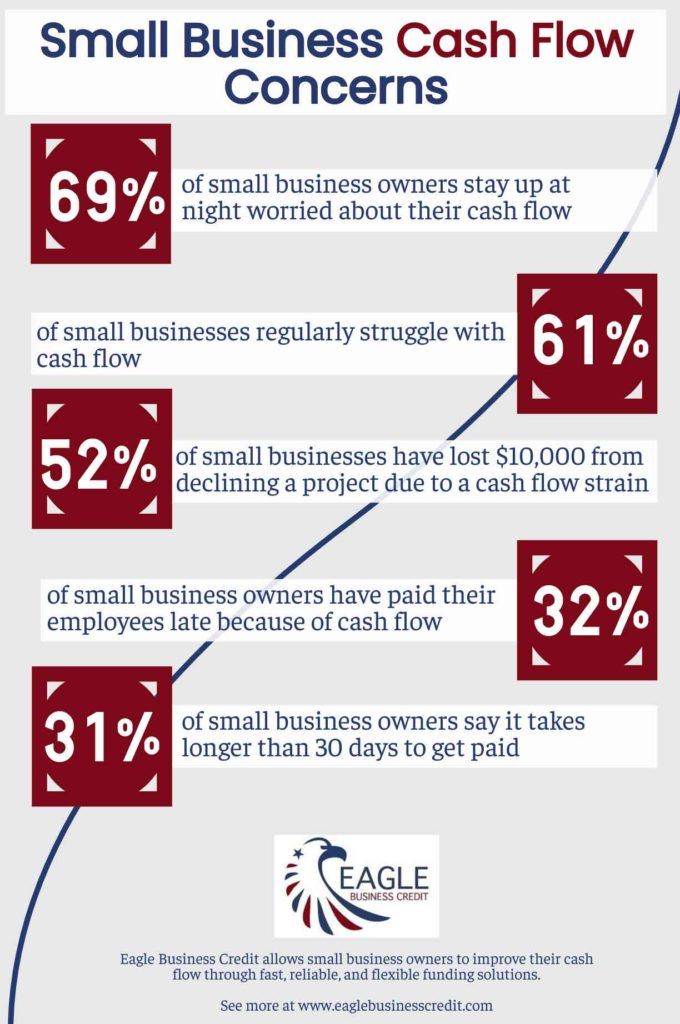

If you are concerned about your cash flow, you aren’t the only one. 69% of small business owners have cash flow concerns that keep them up at night according to The State of Small Business Cash Flow by Intuit that surveyed 3,000 small business owners about their cash flow. Cash is king. Cash flow is the lifeblood of your business. If you run your own business, you are probably sick of hearing these phrases. Obviously you need cash on hand in order to keep operating your business. Unfortunately, selling to other businesses on credit terms can mean that you have plenty of revenue, but you could still fail without having strong small business cash flow.

Small Business Cash Flow Problems

Cash flow has increasingly become a problem for small business owners. This is because large companies like Walmart have been extending their payment terms to their suppliers. So the large company has the luxury of more cash on hand, while the small business selling to Walmart has to wait 45 or 60 days to get paid. That means the suppliers have to front the cost of their sale, then wait over a month to collect on the payment and meet their own payment obligations. Cash flow problems are not only an issue with meeting payment obligations, but cash flow problems can stop your from growing your business!

Cash Flow Problems Becoming Growth Problems

Many small business owners know the frustration of hitting a growth plateau. It seems like you’re growing, and you get excited. Then suddenly, you flatten out and can’t figure out how to scale your business further. One common cause of a growth plateau is simply not having enough money to expand. It takes money to make money, and more than half of small business owners have lost over $10,000 from having to turn down new sales opportunities because of cash flow problems. You won’t be able to cover the supplies or labor to make new sales if you are fixated on meeting payroll each month.

Cash Flow Problems Affecting Your Payroll

32% of small business owners have paid their employees late due to cash flow problems. Meeting payroll each month can be incredibly difficult for a small business that is growing. A growing business will demand more cash to fund and support its growth. Supplies, marketing, labor, new products, new locations, and new sales all require more money. If you sell on credit terms, you won’t see the fruit of your labor until a month or more after you finish the job or delivery the product. How will you cover your payroll once or twice a month when you have to wait for collecting on your open invoices?

Cash Flow Problems from Unpaid Invoices

A huge source of cash flow problems is from unpaid invoices. A small business owner an be waiting to collect from their customer due to credit terms or they could have invoices that are past due. The average in outstanding receivables for small businesses in the U.S. is $53,399. This means you have less cash on hand to run your business because your working capital is tied up in your receivables. Unlocking the cash in your accounts receivable means the ability to make more sales, meet payroll, and grow your business.

Small Business Funding Cash Flow Problems

Invoice factoring, also known as accounts receivable funding, is a small business funding solution that helps solve your cash flow problems. Rather than having your available working capital locked up in your accounts receivable, a factoring company provides immediate payment for your invoices, giving you the freedom to run your business with more cash on hand. Eagle Business Credit provides small business funding for cash flow problems in Atlanta, GA and nationwide for small business owners wanting to have stronger cash flow. With our small business cash flow solutions, we can help your business meet its payment obligations and grow!