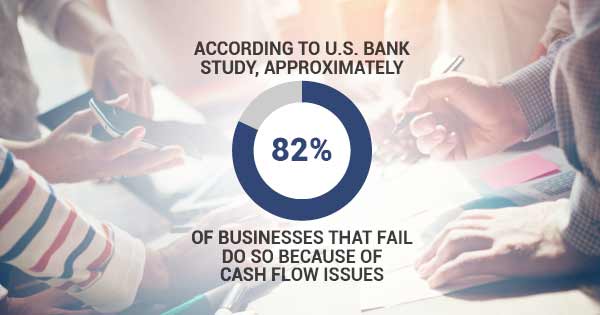

Small business owners operate on tighter margins due to the cash flow strain of business growth. In fact, 82% of failed businesses cite cash flow as a reason. As the owner of your own company, you are responsible for meeting payroll, delivering goods or services, and growing your business. This is hard to do without available working capital, but spending your valuable time searching for working capital financing means overlooking your day-to-day business goals. This is where small business invoice factoring can help.

Small Business Owner’s Guide to Factoring

Invoice factoring involves advanced payment on open receivables. This means that a small business that sells on credit terms no longer has to wait 30 to 60 to 90 days for customer payment. Instead, a factoring company advances the amount of the invoice at a discount. The factoring company may opt to retain a small reserve of the invoice until the client pays the invoice. This means the small business receives an advance of between 80 and 95% of the invoice amount, the factoring company typically keeps between 1 and 5% of the invoice amount, and the remaining reserve amount is released to the client after the transaction.

Small Business Factoring Companies

Choosing a factoring company for small business factoring can be overwhelming because there are plenty of options. To start, try calling the factoring companies and seeing what their rates, customer service, and fees are like. Ask about any fees tucked away in the legal agreement that may cause your business financing to be more expensive than the quote you are given. Financing your business with the right factoring company is crucial when more than half of all invoices are paid late.

Invoice Factoring for Small Businesses

Invoice factoring, or accounts receivable funding, is a debt-free working capital funding solution, so there is no interest or harm to your credit score. In fact, invoice factoring is good for small business owners looking to build their business credit as the cash flow improvement allows for on time and even early payments to your suppliers. A factoring company typically offers free credit checks on your clients, so you can do business with companies that have the money to pay. Additionally, you would have the free time to grow your business instead of managing your receivables or collecting payment from slow paying customers.

Factoring Companies for Small Businesses

Eagle Business Credit is a factoring company offering working capital funding solutions. Our factoring services for small businesses save entrepreneur’s time, money, and stress in running their business. Our flexible funding solutions grow with your business, so no more worrying about reaching the end of your line of credit. If your business is growing and your cash flow is strained, consider small business invoice factoring to finance your company’s needs.