Managing and financing a business startup isn’t easy. After you get your business loan approved and set up shop, the hardest part is staying afloat. Most businesses default in their first year due to a lack of available funds. Most owners don’t realize that there are other options to help finance their startups. Eagle Business Credit specializes in helping businesses get the cash flow they need through invoice factoring. Here are just a few ways you can use factoring services to help finance your startup.

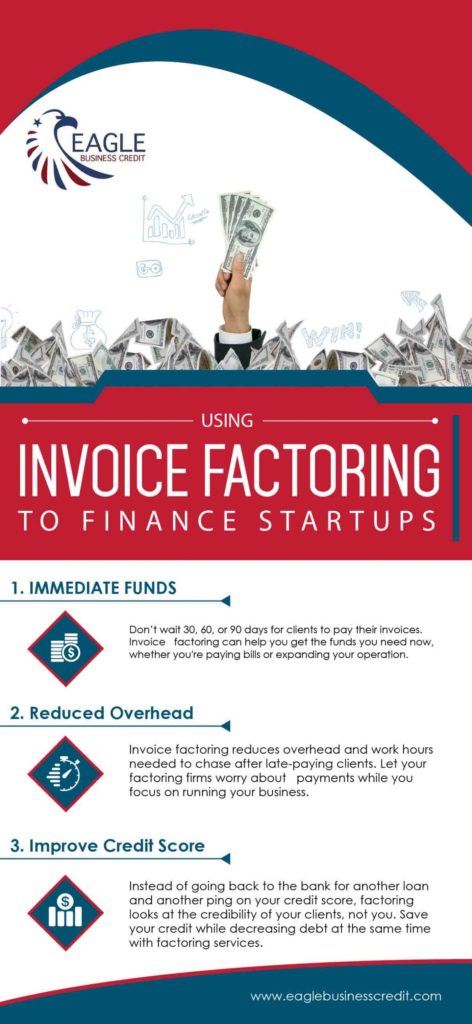

Most new business owners underestimate the amount of money they need to start their business. There’s always extra fees and office supplies; small purchases that can quickly add up. It’s important for new startups to establish a healthy cash flow but when clients opt for delay payments over 30, 60 or 90 days, this can be a challenge. By factoring your company’s invoices, you can get the cash you need faster. Use it to pay the bills, order supplies, or expand your marketing campaign.

New businesses often struggle with balancing overhead costs like office and accounting personnel. Chasing after lay-paying clients take time, and you’d rather spend that time focusing on day-to-day operation. A factoring firm can help you keep overhead costs down and free up valuable working hours by shouldering the burden of lay-paying clients. The firm takes on the responsibility of tracking down clients for payment which means you and your team and focus more on building your business and helping your clients.

New business owners who underestimate their startup costs often end up going back to the bank for another loan. This means another credit check and more debt. By factoring your invoices instead of taking out another loan, you’ll avoid a check credit and avoid adding to your existing debt. Factoring services look at the credibility of your clients, not you when they analyze your accounts receivable.