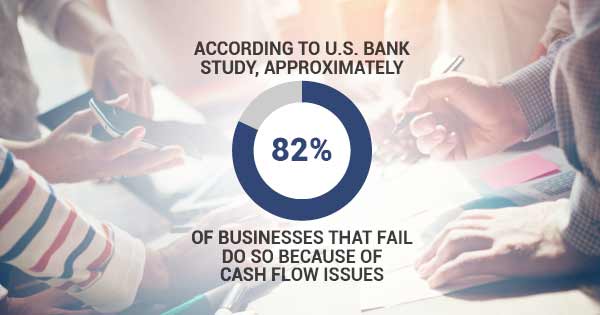

There are so many obstacles to growing your small business. Having enough money to launch, having the time to plan, and managing the stress that comes along with being an entrepreneur is near the top of the list. Cash flow still stands to be the most important factor is enabling or stalling your business growth. When nearly all failed businesses cite cash flow as a reason, you cannot lose sight of managing your cash flow. Here is why you should focus on improving your cash flow.

Why focus on improving your cash flow?

- Meeting payroll

- Taking on larger orders

- Taking on new orders

- Paying your suppliers

- Growing your business

Cash Flow to Pay Your Suppliers

Each month you are making sales and bringing in revenue, but each month you have bills to pay. Most notably, these bills include supplier costs. After all, you can’t deliver a finished product to collect from your customer until you cover the upfront costs of production. Paying your supplier late could mean paying late fees as well. Even worse than late fees, you could be damaging your relationship with your supplier. If these payments are reported to credit bureaus, your business credit could drop. On the other hand, having the cash flow to meet these payment deadlines or even paying early could improve your business relationship, credit score, and lead to vendor discounts.

Focus on Improving Cash Flow to Meet Payroll

Payroll is an upfront cost to your business in order to make sales, deliver product, and bring money in. Once or twice a month your employees need to be paid. Having poor cash flow could jeopardize payroll. This will lead to problems. Your employees may lose motivation or even find another job. The government may slap penalties on your business, and overlooking your most valuable assets (your employees) is never good management. Strong cash flow is a huge factor in growing your business successfully, but having strong cash flow is absolutely necessary just to stay legally compliant.

Taking on Larger and New Orders with Stronger Cash Flow

Making more sales means investing in payroll, supplies, and time. This will increase your overhead and require more capital to cover these production costs. When your capital is tied up in your receivables in the form of open invoices, it can be tricky to afford the costs of making more sales. This means you may have to turn down new business while waiting credit terms to collect on your open invoices. Turning down new sales will not only stall your growth, but it may damage some relationships with potential business partners or customers. Taking on larger sales with existing clients is another opportunity to grow your business. Unfortunately, you may be short of the upfront capital needed to fulfill these orders. This is where a financing method like PO Funding may benefit your growth. Being able to reliably take on new sales requires healthy cash flow to support this growth.

Cash Flow for Small Business Growth

Positive cash flow means your business is taking in more money than is going out. This can be difficult for a small business selling to other businesses on credit terms. You need immediate capital to cover new employees, locations, and products when growing your business. Cutting out unnecessary business costs, staying focused, and finding the right financing partner are all steps you can take as a business owner to improve your cash flow and achieve growth.

How to Improve Your Cash Flow:

The first step in evaluating your cash flow is seeing what expenses your business faces on a recurring basis. Are there any costs you can do without? Remember that leadership requires some tough choices whether that is downsizing your team, tech stack, or even office space. Next, take a look at the credit terms you sell on. Is a lot of your capital tied up in your receivables waiting for collection? Could you renegotiate payment terms to be shorter so you can collect faster? Consider offering a discount for faster payment. Once you have examined the aforementioned areas of your business for capital, look into financing options. There are a lot of business funding options for small business owners. Be sure to look for funding options that improve your cash flow rather than hurting your cash flow. Invoice factoring is a debt-free small business funding option that improves cash flow and grows with the needs of your business. Rather than waiting credit terms for your customers to pay, a factoring company advances payment on your open invoices then waits the duration of credit terms to collect from your customer.