Business loans are typically the first funding option that pops into mind for business owners looking for financing. When searching for the right financing option for your business, evaluate the cost and amount of funding available to you. Then, consider the amount of time between application and funding. Here is a comparison of typical business loans and AR funding for small business owners.

When looking for a business funding option, evaluate the:

- Time until first funding

- Cost of funding

- Amount of funding

Time to Receive a Business Bank Loan

The average time it takes between applying for a business bank loan and getting funding can vary depending on several factors. These factors include the complexity of the loan application, the specific requirements of the lender, the size and type of the loan, the borrower’s creditworthiness, and the overall efficiency of the loan approval process.

In general, the time frame can range from a few weeks to several months. For smaller loans or lines of credit, the process can be relatively faster, taking a few weeks or even days in some cases. On the other hand, larger loans or more complex financing arrangements may involve a longer evaluation and approval process, extending the timeline to several months.

It’s worth noting that different lenders have varying procedures and turnaround times. Traditional banks might have lengthier application and approval processes compared to alternative lenders such as online lenders or peer-to-peer lending platforms. These alternative sources of funding may offer quicker decision-making and disbursement of funds.

Time to Receive AR Funding

In general, the time frame for AR financing can be relatively quick compared to traditional bank loans. Once the application is submitted and the lender has reviewed the necessary documentation, the funding process can be completed in a matter of days to a few weeks.

The specific timeline for AR financing can be influenced by factors such as:

- Application and Documentation: The time it takes to gather and submit the required application documents, such as invoices, customer information, and financial statements, can impact the overall timeline.

- Due Diligence and Underwriting: Lenders typically conduct due diligence and underwriting processes to assess the creditworthiness of the borrower and the quality of the accounts receivable. AR funding companies typically do not rely on a borrower to have high credit.

- Setup and Agreement: Once the due diligence is complete and the financing terms are agreed upon, there may be additional steps involved in setting up the financing arrangement and finalizing the legal and contractual aspects.

It’s important to note that different lenders may have varying processes and turnaround times for AR financing. Eagle Business Credit can make approval decisions in as little as one day. Business credit scores are less important to invoice factoring companies when evaluating an application, and Eagle requires different financial documents compared to banks. We evaluate the strength of your invoicing, so invoices will be important for us to look at, but we care less about your balance sheet or time in business.

Cost of a Business Loan

The average cost a business owner pays on a business bank loan can vary based on several factors, including the interest rate, loan term, loan amount, and the borrower’s creditworthiness. The primary cost associated with a business bank loan is the interest expense.

The interest rate on a business bank loan can be fixed or variable and is typically expressed as an annual percentage rate (APR). The APR represents the total cost of borrowing, including both the interest and any applicable fees or charges. The interest rate charged by the lender depends on various factors, such as the borrower’s credit score, the loan’s collateral, and market conditions.

Additionally, some lenders may also charge origination fees, application fees, processing fees, or other administrative costs. These fees are usually expressed as a percentage of the loan amount or as a flat fee.

Cost of AR Funding

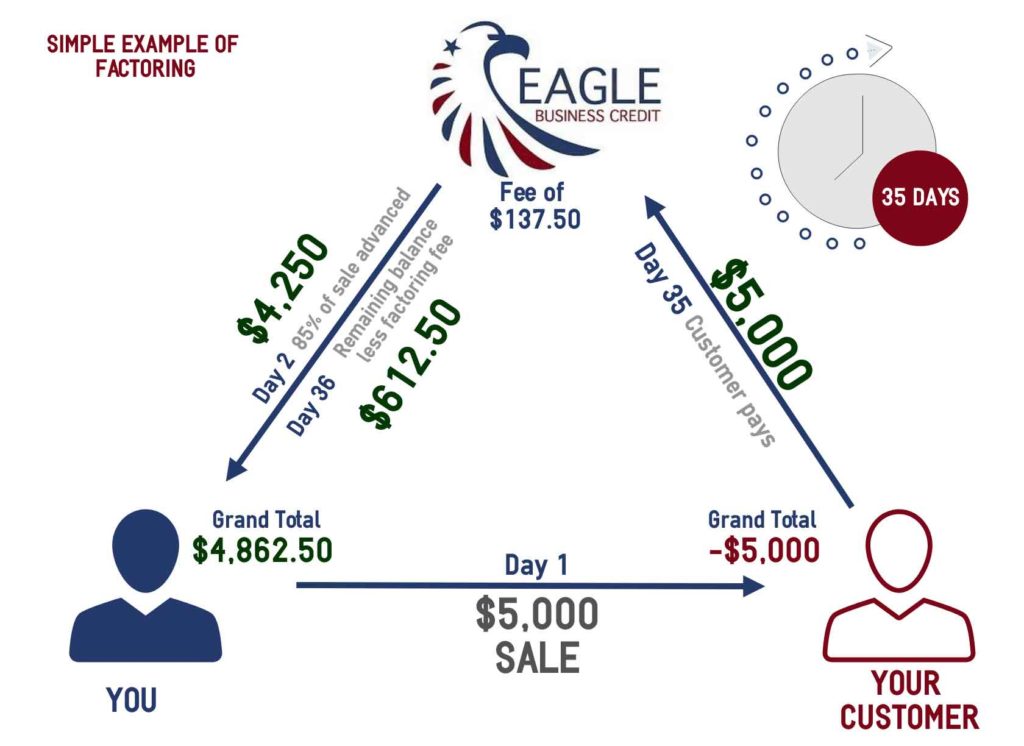

Eagle’s average AR funding rate is around 2-4%. This means the cost of factoring an invoice will be 2% to 4% of the invoice amount. The rate is based on the creditworthiness of your customers, the volume and quality of your invoices, and the industry.

Notably, our costs at Eagle are not tied to interest rates. This means an increase in interest rates does not necessitate an increase in the rate you pay for funding. Some companies will include hidden fees in their financing, but we practice transparency in our funding.

Business Bank Loan Funding Amount

Lenders typically consider the borrower’s ability to repay the loan when determining the loan amount. They may assess factors such as the business’s financial statements, cash flow projections, and the borrower’s personal credit history. Based on this assessment, lenders may offer a loan amount that they deem appropriate and manageable for the borrower.

While it’s difficult to provide an average percentage amount, business owners may receive funding ranging from a fraction of their requested loan amount to the full loan amount. Some lenders may be more conservative and provide a smaller percentage of the requested loan amount, especially if the borrower’s creditworthiness or financial stability raises concerns. Other lenders may offer a higher percentage, particularly if the borrower has a strong credit profile and meets their eligibility criteria.

AR Funding Amount

The amount of funding you receive from AR funding depends on the amount of your invoices. More sales means more funding. When customers pay the invoices after the expiration of credit terms, the amount of funding available to your business replenishes. AR funding can typically be used alongside other funding options. Therefore, AR funding is a great option for additional funding needs that are based on the sales of your business. Growing businesses benefit from AR funding, since their funding needs can rapidly increase with big sales.

Business Bank Loans or AR Funding

When evaluating between a bank loan or AR funding for your business financing needs, be sure to evaluate the time to funding, cost of funding, and the funding amount. There are plenty of business financing options available, but make sure you pick the option that best fits your needs. Eagle provides AR funding for small business owners. AR funding is tailored to your business needs and could help you find business growth.