Starting a small business can be an exciting venture filled with dreams of success and profitability. While many new entrepreneurs are keenly focused on generating profits, they often overlook a critical factor that plays a pivotal role in achieving that goal: working capital. In this article, we will explore the essential relationship between working capital and profit, breaking down complex financial concepts into digestible bites for small business owners.

Understanding Working Capital

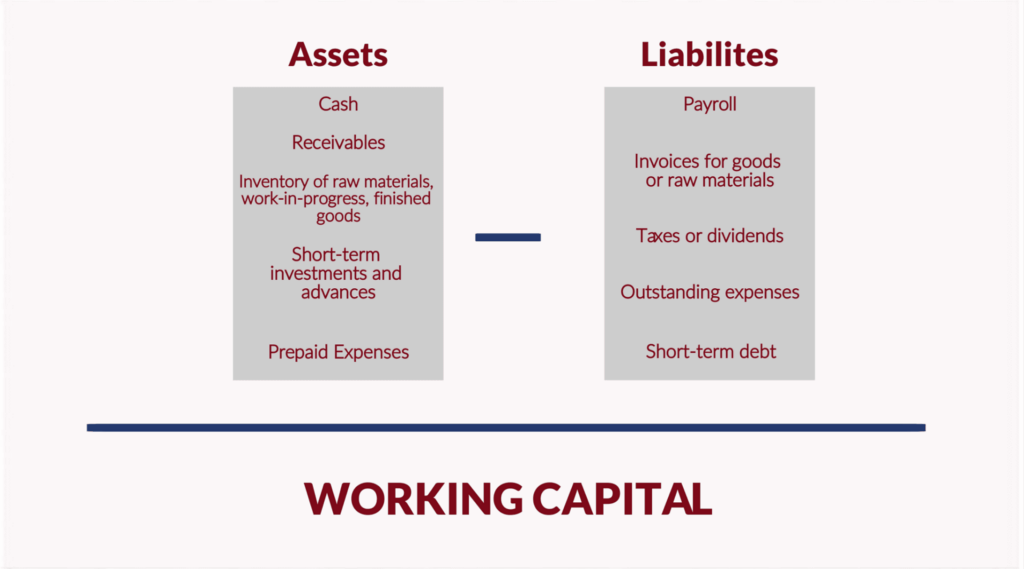

Let’s start with the basics. Working capital is the lifeblood of any business, especially small ones. Simply put, working capital represents the funds available for day-to-day operations. It is the difference between a company’s current assets (like cash, accounts receivable, and inventory) and its current liabilities (such as accounts payable and short-term debt).

Why Working Capital Matters

Imagine working capital as the oil that keeps the gears of your small business turning smoothly. Having sufficient working capital ensures you can cover your immediate expenses, pay your suppliers, meet payroll obligations, and invest in opportunities for growth.

Working Capital vs. Profit

Here’s where many small business owners get tripped up: working capital and profit are not the same thing. Profit is the surplus money you have after deducting all expenses from your revenue. On the other hand, working capital is about ensuring you have enough cash and assets to operate efficiently.

The Interplay Between Working Capital and Profit

Now, let’s explore the intricate dance between these two financial concepts:

- Cash Flow Management: Proper working capital management ensures you have enough cash to pay your bills and avoid late payments. This, in turn, helps maintain your business’s reputation and relationships with suppliers. A strong cash flow management system contributes to profit by preventing unnecessary penalties and fees.

- Inventory Management: Effective control of your inventory levels is crucial for optimizing working capital. Holding excessive stock ties up valuable capital that could be invested elsewhere. Conversely, having too little inventory can lead to lost sales. Striking the right balance can boost profitability.

- Accounts Receivable: Promptly collecting payments from customers improves your working capital position. Aging accounts receivable can strain your resources and hinder your ability to invest in growth. By managing accounts receivable efficiently, you can free up capital for profit-generating activities.

- Accounts Payable: While it may be tempting to delay payments to suppliers to bolster working capital temporarily, it’s not a sustainable strategy. Maintaining healthy relationships with suppliers is essential, as they provide the goods and services needed to operate your business. A strong working capital position enables you to negotiate favorable terms, ultimately benefiting your profitability.

- Growth Opportunities: Working capital is essential when seizing growth opportunities. Whether it’s expanding your product line, opening a new location, or investing in marketing, having the necessary capital readily available allows you to pursue profit-enhancing ventures.

- Crisis Coverage: An adequate working capital cushion can help your small business weather unexpected storms, such as economic downturns or the impact of unforeseen events. By being financially prepared, you can safeguard your profit margins during challenging times.

Balancing Act for Small Business Profit

While working capital is critical for your business’s day-to-day operations, it’s essential to strike a balance between working capital needs and profitability goals. Here are some key strategies to achieve this equilibrium:

- Regular Financial Analysis: Routinely review your financial statements to assess your working capital position and profitability. Identify areas that may require adjustments and take proactive steps to address them.

- Forecasting: Develop accurate financial forecasts that consider both short-term working capital requirements and long-term profit objectives. This will help you allocate resources effectively and make informed decisions.

- Efficiency Improvements: Continually seek ways to enhance the efficiency of your operations. Streamlining processes can reduce working capital tied up in unnecessary expenses and contribute to higher profits.

- Access to Financing: Maintain access to various financing options, such as business loans or lines of credit, to cover temporary working capital shortfalls. Just be sure to use them wisely, as interest costs can eat into profits.

- Invoice Factoring: Selling your invoices to a factoring company is an interest-free method of generating working capital. Debt-free with typically a 1-4% discount on the invoice amount, the upfront capital can help business growth and supplier payments.

- Customer and Supplier Relationships: Nurture strong relationships with customers and suppliers. This can lead to faster payments and more favorable terms, positively impacting both working capital and profit.

Invoice Factoring to Generate Working Capital

There is no direct profit from factoring invoices. Instead, invoice factoring can generate working capital and allow opportunities for business growth. Used effectively, invoice factoring can lead to profit, growth, and healthy supplier relationships. There are a few benefits to growth:

- Time: Some factoring companies—like Eagle Business Credit—can manage the back end of a business’s invoicing process. This can save your business valuable time and resources during the invoice collection process, resting assured that your factor is handling it for you.

- Transparency: With accessible and transparent financial dashboards at your fingertips, your factoring relationship can help show you cash flow snapshots and working capital generation.

- Cash Is King: Having cash on hand instead of waiting 30 or 60 days for invoice payments means having the ability to invest, grow, and pivot your business into a profit-generating machine.

- Relationships: Eagle Business Credit provides top notch customer service, with financial experts in every capacity. The symbiotic relationship of a factoring company means your business growth is in both of our best interests. Efficiency in the invoicing process can lead to mutual growth.

- Supplier Happiness: When payments are made on-time or early, suppliers are more likely to want repeat business and greater business with your company. Some suppliers offer discounts for early payments, and with more cash on hand, you can secure those discounts and reap the rewards.

Using Working Capital to Increase Profit

In the world of small business, the relationship between working capital and profit is undeniably intertwined. As a new small business owner, recognizing this connection and managing it effectively is crucial to your long-term success. Remember, while profit may be the ultimate goal, working capital is the foundation upon which your profitability is built. By maintaining a healthy balance between these two financial pillars, you’ll be well-equipped to navigate the challenges and opportunities that come your way, setting the stage for a thriving small business.